44b65c63:73100e33

posted

3 days ago

Saylor’s face when Scottie Pippen claims he met Satoshi “back in 1993.”

#Bitcoin #BTC #UnitedStates #US #MichaelSaylor #Nostr https://video.nostr.build/d094e5fe52776c8e9db81cd6c68aad1780d292486e8aa461fb34c53e7324f207.mp4

44b65c63:73100e33

posted

3 days ago

Saylor’s face when Scottie Pippen claims he met Satoshi “back in 1993.”

#Bitcoin #BTC #UnitedStates #US #MichaelSaylor #Nostr https://video.nostr.build/d094e5fe52776c8e9db81cd6c68aad1780d292486e8aa461fb34c53e7324f207.mp4

8ac36c32:93f45a30

posted

3 days ago

#Bitcoin

8ac36c32:93f45a30

posted

3 days ago

#Bitcoin

atyh

posted

3 days ago

that phrase means very little 😂

e07bfc04:b2b651ed

posted

3 days ago

Fix the money, fix the world.

#Bitcoin

e07bfc04:b2b651ed

posted

3 days ago

Fix the money, fix the world.

#Bitcoin

Maria2000

posted

3 days ago

Morning😊☕

Maria2000

posted

3 days ago

Morning☕😊

44b65c63:73100e33

posted

3 days ago

RFK Jr: “#Bitcoin is not only an off-ramp to this inflationary highway, but it’s also restoring integrity to our government and personal freedoms.”

#Bitcoin #BTC #RFK #DonaldTrump #UnitedStates #US #Nostr https://video.nostr.build/a000207fc2e8106a5611796a1fe5fca8214b32de705ae22cb06b0849b1f0f9ba.mp4

44b65c63:73100e33

posted

3 days ago

RFK Jr: “#Bitcoin is not only an off-ramp to this inflationary highway, but it’s also restoring integrity to our government and personal freedoms.”

#Bitcoin #BTC #RFK #DonaldTrump #UnitedStates #US #Nostr https://video.nostr.build/a000207fc2e8106a5611796a1fe5fca8214b32de705ae22cb06b0849b1f0f9ba.mp4

Chip

posted

3 days ago

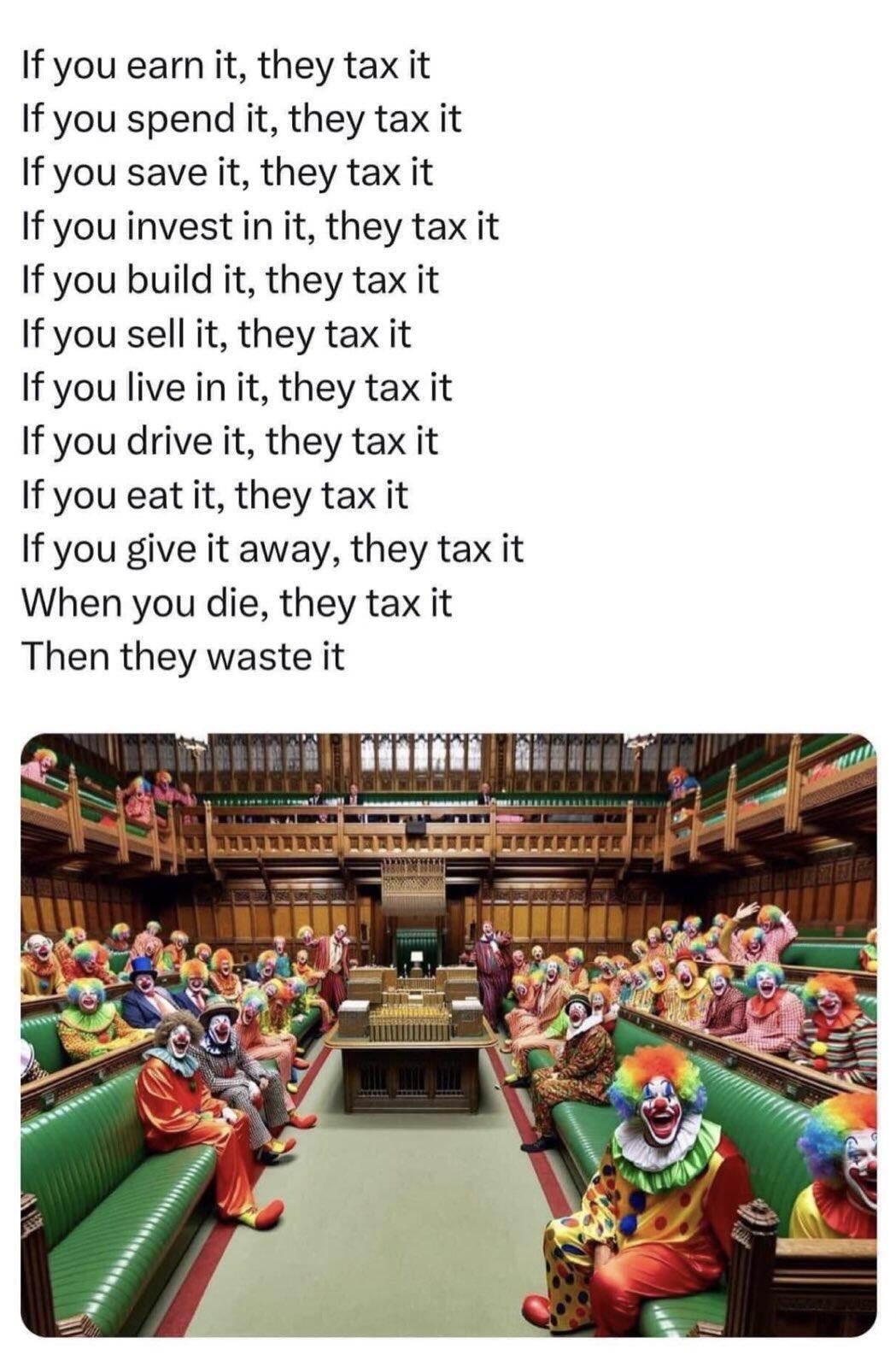

How’d ya get a pic of all my frens?

Maria2000

posted

3 days ago

Morning😊☕

Maria2000

posted

3 days ago

Have a great day☕😊

Maria2000

posted

3 days ago

Morning, glad you rested well😊☕

6596d001:44e1e5ed

posted

3 days ago

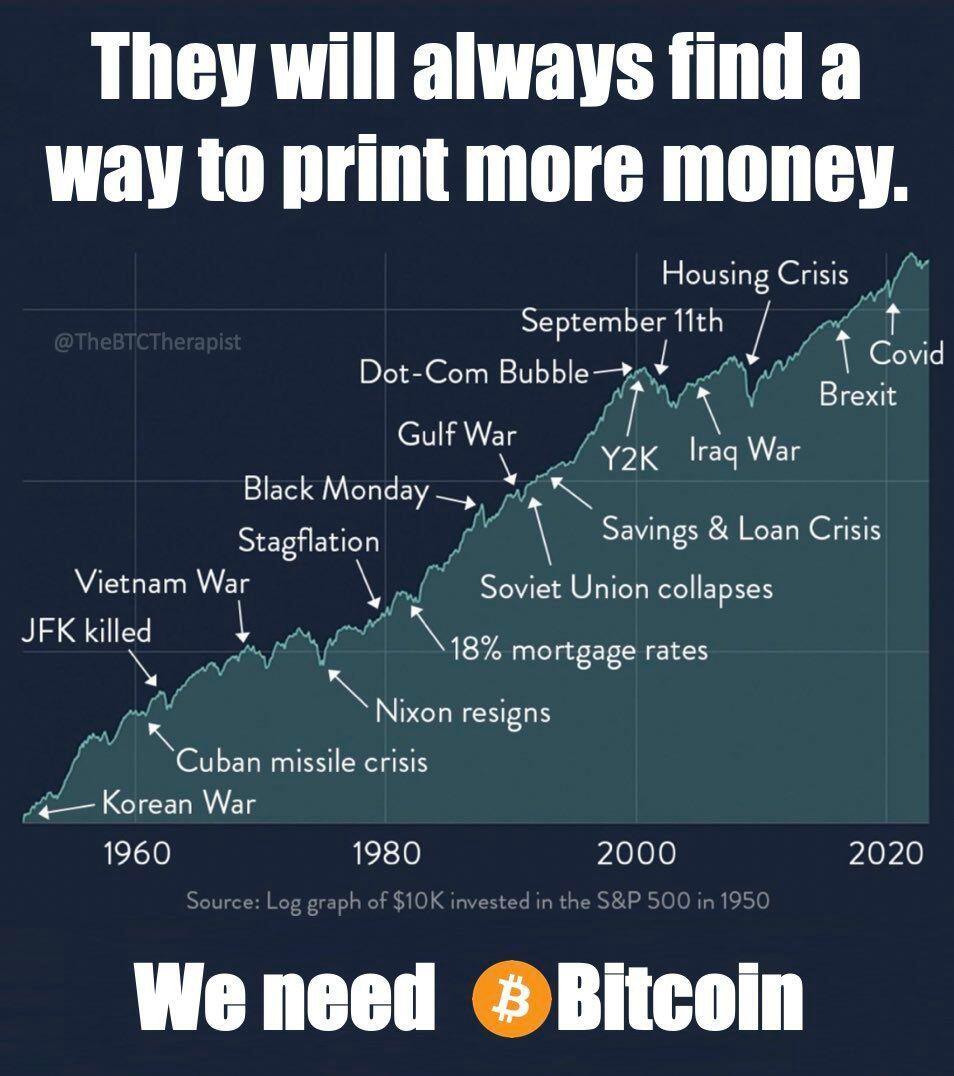

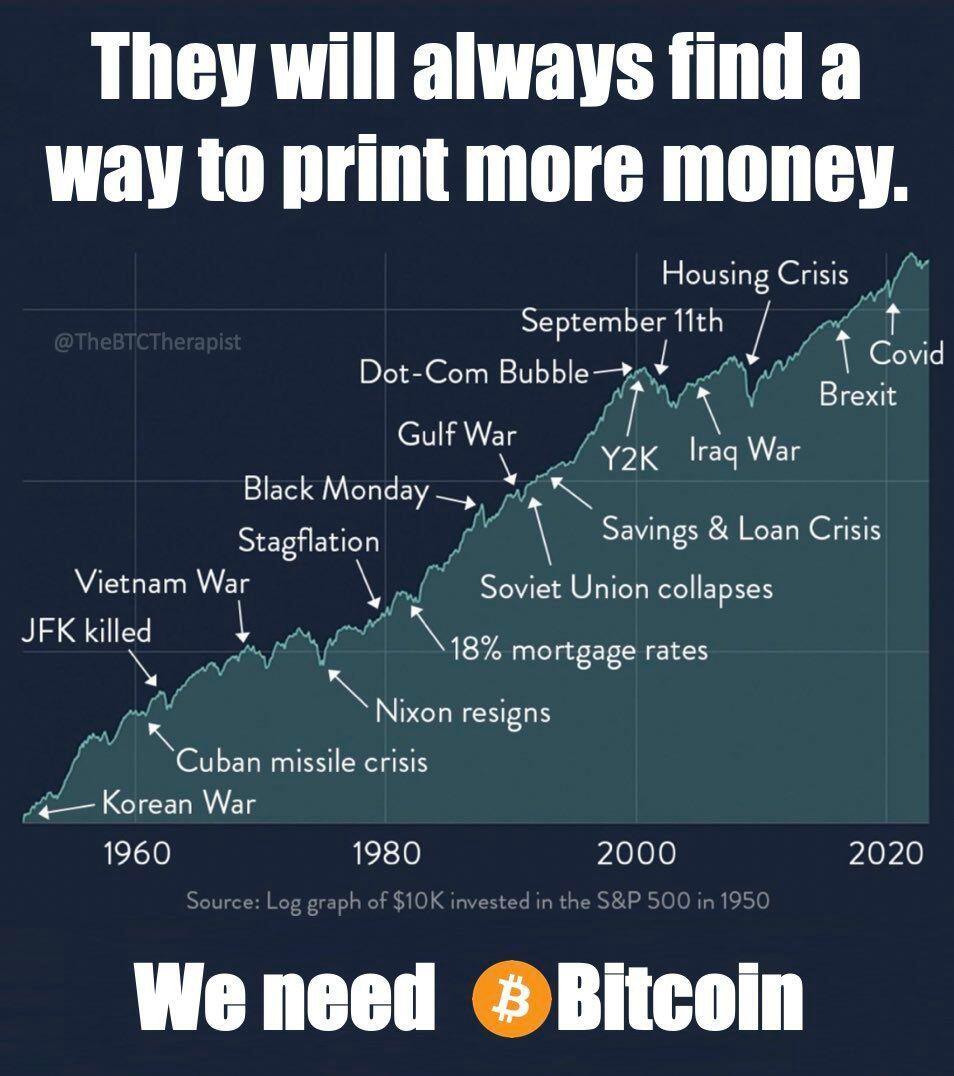

They will always find a way to print more money.

We need #Bitcoin

fiatjaf

posted

3 days ago

This bot was offline for unknown reasons, but it is back now.

nostr:nevent1qvzqqqqqqypzp7wadfmz2p3xpvu295l9k3jzz0pwglarsa6znl57uc8qwx335p7hqyvhwumn8ghj7enfv96x5ctx9ehx7um5wgcjucm0d5hszrthwden5te0vfexytnfduhsz8mhwden5te0vfhhxarj9ekxjemgw3hxjmn8wdcx7un99e3k7mf0qywhwumn8ghj7cn0wd68ytnzd96xxmmfde68smmtduhxxmmd9uq3xamnwvaz7tmzdaehgu3wdahxc6twv5hsqgy2rjrk4828rhva070d2wk40c4jqvk2tuvyn08p2zc0d2qnxndl5gcxx9n8

Maria2000

posted

3 days ago

Have a great day☕😊

HODL

posted

3 days ago

This must be a bull market because I finally decided I was prosperous enough to be able to afford YouTube premium lol 😂

5ba9c4df:a698c7ef

posted

3 days ago

https://www.youtube.com/watch?v=4LqpGrWGNqE

Here’s a summarized version of Michael Saylor’s talk **"Bitcoin, The Red Wave, and The Crypto Renaissance"** in **5-10 key bullet points** with timestamps:

1. **Economic Challenges and Bitcoin as a Solution (00:36–03:43)**

- Many companies struggle to outperform monetary inflation due to traditional treasury strategies and bond holdings, resulting in capital losses.

- Bitcoin is presented as a superior store of value, consistently outperforming traditional asset classes like bonds, gold, real estate, and even equities.

2. **Bitcoin's Unmatched Performance (03:43–05:39)**

- Over the past 14 years, Bitcoin has delivered unparalleled returns, averaging 60% annually in recent years.

- Saylor compares Bitcoin's growth to revolutionary advancements like nuclear reactors and airplanes, emphasizing its structural advantages.

3. **First Principles and Bitcoin’s Core Innovation (07:19–12:20)**

- Bitcoin enables storing and transferring value without a trusted intermediary, which Saylor describes as a revolutionary advancement for $450 trillion of global capital.

4. **Digital Capital and Global Implications (14:18–19:23)**

- Bitcoin’s digital and borderless nature makes it more secure and desirable than physical assets in volatile regions.

- Its robust security (733 exahash computing power) and decentralized nature position Bitcoin as the dominant digital monetary network.

5. **MicroStrategy’s Bitcoin Strategy (24:37–28:24)**

- MicroStrategy pioneered corporate Bitcoin adoption, using intelligent leverage to acquire Bitcoin and outperform major indices like the S&P 500.

- Saylor highlights how MicroStrategy’s approach generates significant returns with low risk.

6. **The Case for Tokenization and Regulatory Reform (40:03–47:20)**

- Saylor advocates for tokenizing traditional assets like equities and bonds to enhance liquidity and efficiency.

- He emphasizes the need for clear guidelines to support the adoption of digital assets and frameworks for stablecoins.

7. **The Strategic Bitcoin Reserve (50:10–56:00)**

- Saylor introduces the concept of a U.S. Strategic Bitcoin Reserve, supported by Senator Lummis, to cement Bitcoin as a core reserve asset for the U.S.

- He argues this move would secure the U.S.'s economic leadership in the 21st century while strengthening the dollar as the global reserve currency.

8. **Bitcoin’s Asymmetric Bet (56:00–59:23)**

- Saylor describes Bitcoin as an asymmetric investment: minimal downside due to fiat money costs and enormous upside potential as a global reserve asset.

- He underscores the political momentum supporting Bitcoin adoption, including endorsements from figures like Senator Lummis and the Trump administration.

9. **Future Outlook (59:23-End)**

- The U.S. faces a critical decision: adopt Bitcoin proactively or risk falling behind.

- Saylor envisions a potential $16 trillion market impact if the Strategic Bitcoin Reserve framework is fully realized.

This summary captures the essence of Saylor’s arguments, focusing on Bitcoin's performance, utility, and strategic importance for corporations and nations.

#bitcoin #siamstr

Maria2000

reposted

3 days ago

{"id":"2b5544233a3d788ce492d35c422635360352931193ba975bd4fd03f8702c191f","pubkey":"0c9e5e17fbdf555ef41daf3c3a196749c848f9c791966f30fae5e4c0480e870b","created_at":1731845259,"kind":1,"tags":[["t","grownostr"],["t","damus"],["t",""]],"content":"Another #grownostr , and maybe now a #damus enhancement request as that’s my client of choice, is to show frequently used hashtags in the compose window as you type #. Also to show the @ and # symbols as icons next to the image and camera icons.","sig":"c92baee496073a776cbcf3ea924927aca23709e9fbe540f17f4a7154f22eab4c2aba7f62588163d504cfdb721aa7ffbbbdac62b7245ee0da1eb268038d232efc"}

mcshane

posted

3 days ago

wow

Maria2000

posted

3 days ago

Morning😊☕

Maria2000

posted

3 days ago

Morning☕😊