63c1890f:4fe3f1b1

posted

2 days ago

#bitcoin at $90,000 as supply is dropping quickly! What can we get up too! LFG!!!!

63c1890f:4fe3f1b1

posted

2 days ago

#bitcoin at $90,000 as supply is dropping quickly! What can we get up too! LFG!!!!

The: Daniel⚡️

posted

2 days ago

I’ve been told I put the TD in TDS. 😂

elsat

posted

2 days ago

Regulate hash into existence is on brand

TheGuySwann

posted

2 days ago

That’s a long discussion over about 60 years. But the short version is regulatory capture, corrupt “science,” and how horribly broken our money is.

Money printing is literally a form of silent slavery. Those with access to the printer can consume and own everything in society while everyone else ends up renting it from them. This has occurred in almost every industry in this country over the past ~60 years. I have a podcast that’s basically built entirely around explaining how.

863f2c55:87fee183

posted

2 days ago

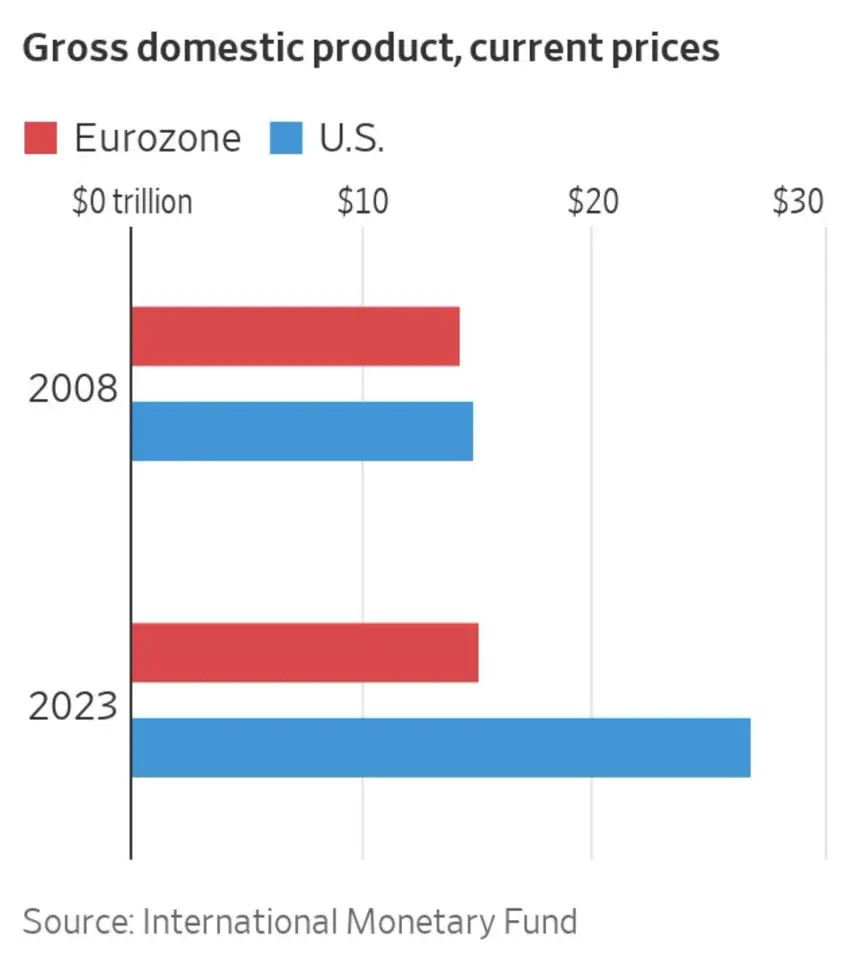

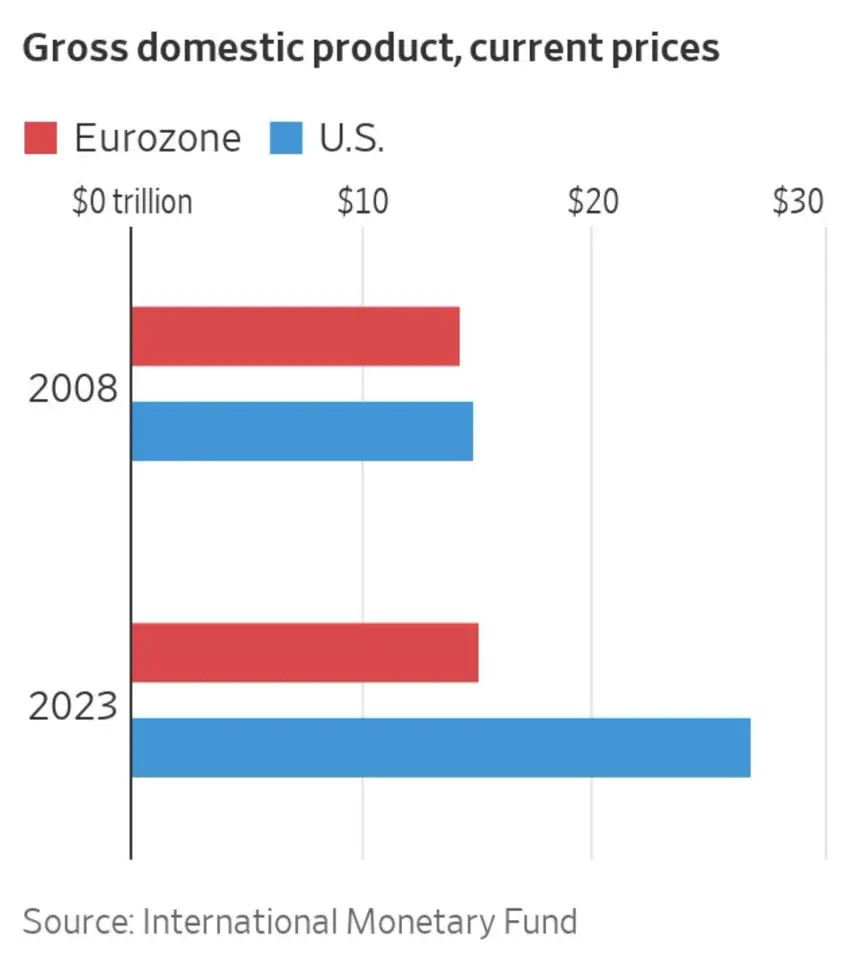

How The USA Left The EU In The Dust

The financial market crisis of 2008 quickly translated into a sovereign debt crisis in the EU, exposing the weaknesses of the monetary union of different economies and the decentralization of political power. The EU has been going downhill ever since, as the EU's response to the problems caused by centralization and regulation has always been the same: more regulation, more centralization.

Comparing what has happened since 2008 with the US, it is striking that despite similar problems, a debt crisis, interventionism through statist policies, the US economy has managed to leave the Europeans in the dust. Its system is resilient in fending off attacks by the state and protecting the spirit of entrepreneurship. As a result, it has succeeded in turning productivity gains into prosperity, while in the EU only one sector continues to grow: the state economy and the sprawling welfare state.

Europeans should now watch out for what happens if the new US government succeeds in rolling back the state and allowing more private enterprise. The USA could be the dry sponge that soaks up mobile capital from all over the world and in this way holds the torch of freedom high. Let us hope, for the sake of Europeans, that America can once again become a haven of freedom and a sovereign citizenry.

Let's leave the losers to their naive substitute belief in the god 'state' that pretends to feed them but in reality plunders them to the bone.

At the same time, the arrival of Bitcoin in the economic psyche of the United States, its integration into the financial system and the savings plans of citizens offers a unique opportunity to return to freedom and sovereignty. The fact that it was once again German politicians, of all people, who sold the coins stolen by the state a few months ago at the lowest price again is indicative of the intellectual crisis of the old continent, in which a bureaucracy decoupled from reality is leading the reigns of power. This cannot go on.

#usa #eu #trump #gfc #mises #socialism #ecb #debtcrises #bitcoin #freemarket

863f2c55:87fee183

posted

2 days ago

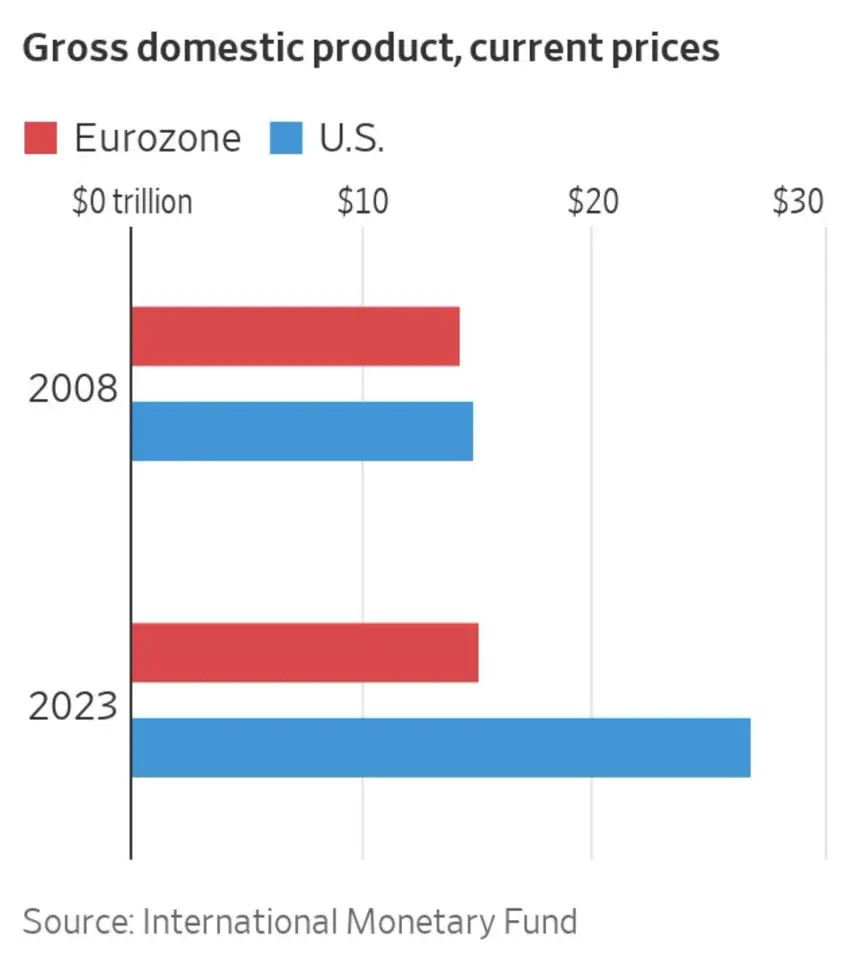

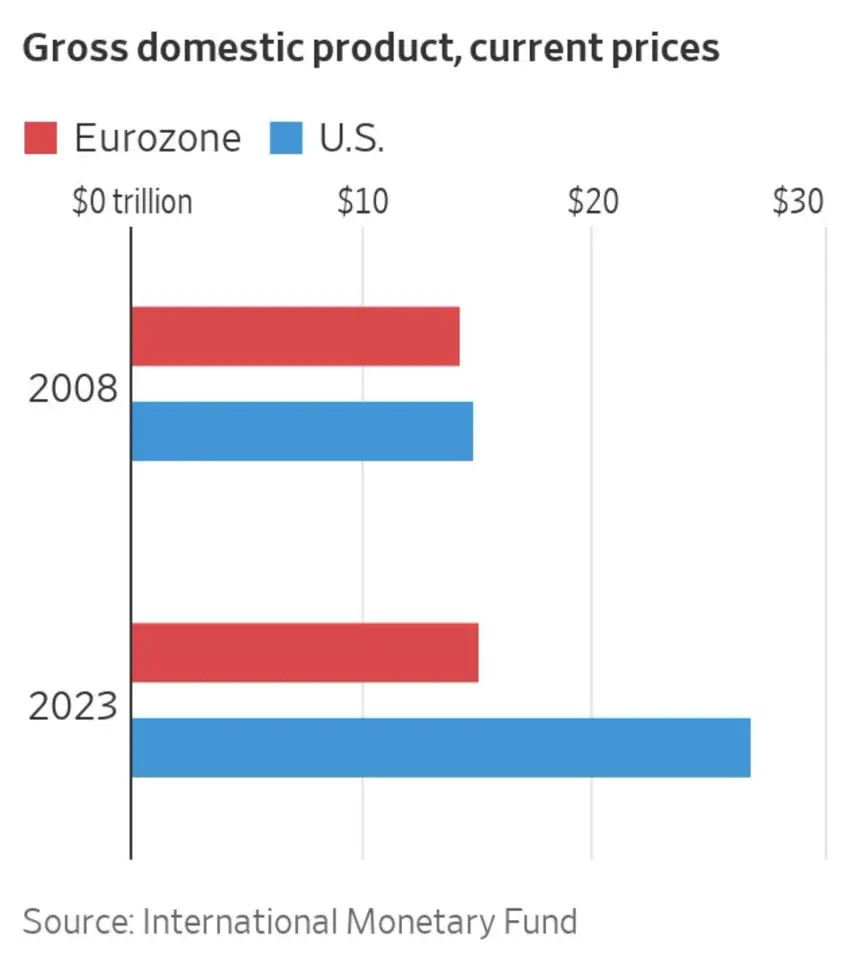

How The USA Left The EU In The Dust

The financial market crisis of 2008 quickly translated into a sovereign debt crisis in the EU, exposing the weaknesses of the monetary union of different economies and the decentralization of political power. The EU has been going downhill ever since, as the EU's response to the problems caused by centralization and regulation has always been the same: more regulation, more centralization.

Comparing what has happened since 2008 with the US, it is striking that despite similar problems, a debt crisis, interventionism through statist policies, the US economy has managed to leave the Europeans in the dust. Its system is resilient in fending off attacks by the state and protecting the spirit of entrepreneurship. As a result, it has succeeded in turning productivity gains into prosperity, while in the EU only one sector continues to grow: the state economy and the sprawling welfare state.

Europeans should now watch out for what happens if the new US government succeeds in rolling back the state and allowing more private enterprise. The USA could be the dry sponge that soaks up mobile capital from all over the world and in this way holds the torch of freedom high. Let us hope, for the sake of Europeans, that America can once again become a haven of freedom and a sovereign citizenry.

Let's leave the losers to their naive substitute belief in the god 'state' that pretends to feed them but in reality plunders them to the bone.

At the same time, the arrival of Bitcoin in the economic psyche of the United States, its integration into the financial system and the savings plans of citizens offers a unique opportunity to return to freedom and sovereignty. The fact that it was once again German politicians, of all people, who sold the coins stolen by the state a few months ago at the lowest price again is indicative of the intellectual crisis of the old continent, in which a bureaucracy decoupled from reality is leading the reigns of power. This cannot go on.

#usa #eu #trump #gfc #mises #socialism #ecb #debtcrises #bitcoin #freemarket

dodgyOkra

posted

2 days ago

https://x.com/PaaLuttuCStudio/status/1858123247012716550

#getcode #kin #solana #bitcoin #memes #binance #tiktok #ethereum #africa #argentina #brazil #china #elsalvador #india #indonesia #japan #nigeria #southafrica #uganda #gm

TIP @PaaLuttuCStudio, PLEASE:

👇

https://tipcard.getcode.com/X/PaaLuttuCStudio

a8e02a7b:fc0b4042

posted

2 days ago

FINALLY, it's here I've been waiting for this more than Saylor on Joe Rogan.

Saif is about to orange pill the entire Arab nations. #bitcoin #nostr #pleb #zap

mattn

posted

2 days ago

WoS と違って誰から受け取ったか分かる

a8e02a7b:fc0b4042

posted

2 days ago

FINALLY, it's here I've been waiting for this more than Saylor on Joe Rogan.

Saif is about to orange pill the entire Arab nations. #bitcoin #nostr #pleb #zap

43bb87e2:12cc9cb8

posted

2 days ago

GM 👋 #NOSTR FRENS ☀️

HAPPY SUNDAY to YOU 🫵 ALL!

MAY GOD BLESS 🙏 YOU AND GIVE YOU PEACE TODAY 🕊️

MOON 🌕 WAS PRETTY THIS MORNING AND FULL AS EVER JUST GLOWING AWAY IN THE SKY! 🌌 SUNS NOT UP YET BUT WILL BE ANY MINUTE 🌅

WHATS ON YOUR AGENDA FOR THE DAY? ARE YOU RELAXING OR ARE YOUR WORKING TODAY?

MY DAUGHTER SINGS AT CHURCH ⛪️ THIS MORNING SO WE ARE ABOUT TO HEAD OUT FOR THAT. AFTER THAT THEN GROCERY SHOPPING, CLEANING 🧼 🧹🧽🧺 AND SOME FUN 🤩 LATER TODAY IF TIME ALLOWS.

OUR DOG LUCKY 🍀 🐾 WOKE UP WITH A SWOLLEN EYE LID TODAY. NOT TO BAD BUT I WILL HAVE TO KEEP AN EYE ON IT SO IT DOESNT GET WORSE.

MANY BLESSINGS FRENS 💜🫂

LOVE YOU ALL ❤️

STAY SAFE 🔫

STAY FREE 🏴☠️

STAY SOVEREIGN 🫡

⭐️ BE THE LEGEND YOU WERE BORN TO BE ⭐️

#GrowNostr #PlebChain #Pleblife #Pleb #Bitcoin #v4v #zap #GM #moon #photostr #photo

https://m.primal.net/MYxm.jpg

43bb87e2:12cc9cb8

posted

2 days ago

GM 👋 #NOSTR FRENS ☀️

HAPPY SUNDAY to YOU 🫵 ALL!

MAY GOD BLESS 🙏 YOU AND GIVE YOU PEACE TODAY 🕊️

MOON 🌕 WAS PRETTY THIS MORNING AND FULL AS EVER JUST GLOWING AWAY IN THE SKY! 🌌 SUNS NOT UP YET BUT WILL BE ANY MINUTE 🌅

WHATS ON YOUR AGENDA FOR THE DAY? ARE YOU RELAXING OR ARE YOUR WORKING TODAY?

MY DAUGHTER SINGS AT CHURCH ⛪️ THIS MORNING SO WE ARE ABOUT TO HEAD OUT FOR THAT. AFTER THAT THEN GROCERY SHOPPING, CLEANING 🧼 🧹🧽🧺 AND SOME FUN 🤩 LATER TODAY IF TIME ALLOWS.

OUR DOG LUCKY 🍀 🐾 WOKE UP WITH A SWOLLEN EYE LID TODAY. NOT TO BAD BUT I WILL HAVE TO KEEP AN EYE ON IT SO IT DOESNT GET WORSE.

MANY BLESSINGS FRENS 💜🫂

LOVE YOU ALL ❤️

STAY SAFE 🔫

STAY FREE 🏴☠️

STAY SOVEREIGN 🫡

⭐️ BE THE LEGEND YOU WERE BORN TO BE ⭐️

#GrowNostr #PlebChain #Pleblife #Pleb #Bitcoin #v4v #zap #GM #moon #photostr #photo

https://m.primal.net/MYxm.jpg

The: Daniel⚡️

posted

2 days ago

GM ☀️ PV 🤙

I’m sorry, I must have said a thing that triggered a few sycophants this morning.

rev.hodl

posted

2 days ago

I don't think I've listened or read what you're referencing. Anyone got some links handy?

TheGuySwann

posted

2 days ago

nostr:nevent1qqs0etg0m76pk00qez3874t5tkdj3wnum0pfcrh9p9exhd8nfkex3sgpr9mhxue69uhhxetwv35hgtnwdaekvmrpwfjjucm0d5q3gamnwvaz7tmjv4kxz7fwdehhxarj9e3xwqgjwaehxw309ac82unsd3jhqct89ejhxqguwaehxw309anx2etywvhxummnw3ezucnpdejz7mt9d4jhx064cyj

toxicbitcoiner

reposted

2 days ago

{"sig":"962b0e2cb875cc6da18c0c43c895a83138b7fad17023f7f54630593d84945eb88f5920e9c94ab7a817246b57b5a7dbff206d6b2c664242a277afd7905493c592","content":"Nocoiners when I try to introduce them to Bitcoin and they fuck themselves over by not taking self-custody or using leverage because they want 1000x to get out of the hole they dug by ignoring the obvious trade for over 10+ years \n\nhttps:\/\/m.primal.net\/MYxW.mp4 ","pubkey":"7ecd3fe6353ec4c53672793e81445c2a319ccf0a298a91d77adcfa386b52f30d","tags":[],"id":"4181aba12d71e676be201eb0455eaaa2a5517ae2034026edd8bbc980374c0e67","created_at":1731850363,"kind":1}

f776bcc1:9901da4a

posted

2 days ago

We have already gathered 86% of the total amount, we are soo closee!!!

Only 134$ left!! We are in the final stretch !!

Thanks really much #nostr you all are awesome!!!

#photostr #photography #artstr #plebchain #nostr

nostr:nevent1qqszs74rg9wswg6rj7u4pwvz5ty9uujavdflh0sfv52eg0qx3qj6zxqpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsyg8hw67vzgn3heulcudk2heuhl4n4zsknue7uye4lnqvy2pfjqw6fgpsgqqqqqqsj73dpw

f776bcc1:9901da4a

posted

2 days ago

We have already gathered 86% of the total amount, we are soo closee!!!

Only 134$ left!! We are in the final stretch !!

Thanks really much #nostr you all are awesome!!!

#photostr #photography #artstr #plebchain #nostr

nostr:nevent1qqszs74rg9wswg6rj7u4pwvz5ty9uujavdflh0sfv52eg0qx3qj6zxqpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsyg8hw67vzgn3heulcudk2heuhl4n4zsknue7uye4lnqvy2pfjqw6fgpsgqqqqqqsj73dpw

a8e02a7b:fc0b4042

posted

2 days ago

Saylor brain just had a malfunction on stage. 😂

This one is WILD. #bitcoin #Satoshi #nostr #zap https://video.nostr.build/d094e5fe52776c8e9db81cd6c68aad1780d292486e8aa461fb34c53e7324f207.mp4

a8e02a7b:fc0b4042

posted

2 days ago

Saylor brain just had a malfunction on stage. 😂

This one is WILD. #bitcoin #Satoshi #nostr #zap https://video.nostr.build/d094e5fe52776c8e9db81cd6c68aad1780d292486e8aa461fb34c53e7324f207.mp4

NVK

posted

2 days ago

Most people don't want freedom, they just want a better cell.

bdbe1bdb:dd86e27f

posted

2 days ago

Not specifically bitcoin prices, everything against USD is fine. I can do the final conversion, I have USD historical data.

corndalorian

posted

2 days ago

😂🤣

atyh

posted

2 days ago

protocols not platforms.

the problems of centralization.

https://knightcolumbia.org/content/protocols-not-platforms-a-technological-approach-to-free-speech