8d9d2b77:86dd65fa

posted

9 days ago

Gm😊☕

3d2e5150:8d51d594

posted

9 days ago

It is fundamentally improve to prevent those who want to store data on chain from doing so. There’s nothing to investigate there, there’s only worse ways of doing it and better ways of doing it.

> On top of this, I do not think it is unreasonable to point out that there are people involved in making this decision who will benefit from being able to store large amounts of data in op_return.

I don’t believe this is true. The Citrea instance isn’t material to them. They’re gonna do it either way, either in a really shitty way that bloats the UTXO set or in a better way. The only impact is on Bitcoin, not them.

> rushing this will increase the chance of forks

Huh? This is mempool policy, not consensus logic. People can run other code if they want to but there’s no chance of a fork for mempool policy.

If you mean that people will fork Core, I mean, okay? The issue is ~all the engineers working on Bitcoin Core and mempool policy agree with this change (which should tell you something, they don’t often all agree!), so maintaining a fork without any of the people competent at doing so is not gonna end well.

Or you end up like Knots, a one-man project shipping a ton of barely-tested patches that zero people aside from Luke have reviewed. That’s not a serious project.

e2ccf7cf:26c1c8eb

posted

9 days ago

Not GM, fuck you taxes, I want to die

8d9d2b77:86dd65fa

posted

9 days ago

Gm☕😊

7b991f77:76c2840d

posted

9 days ago

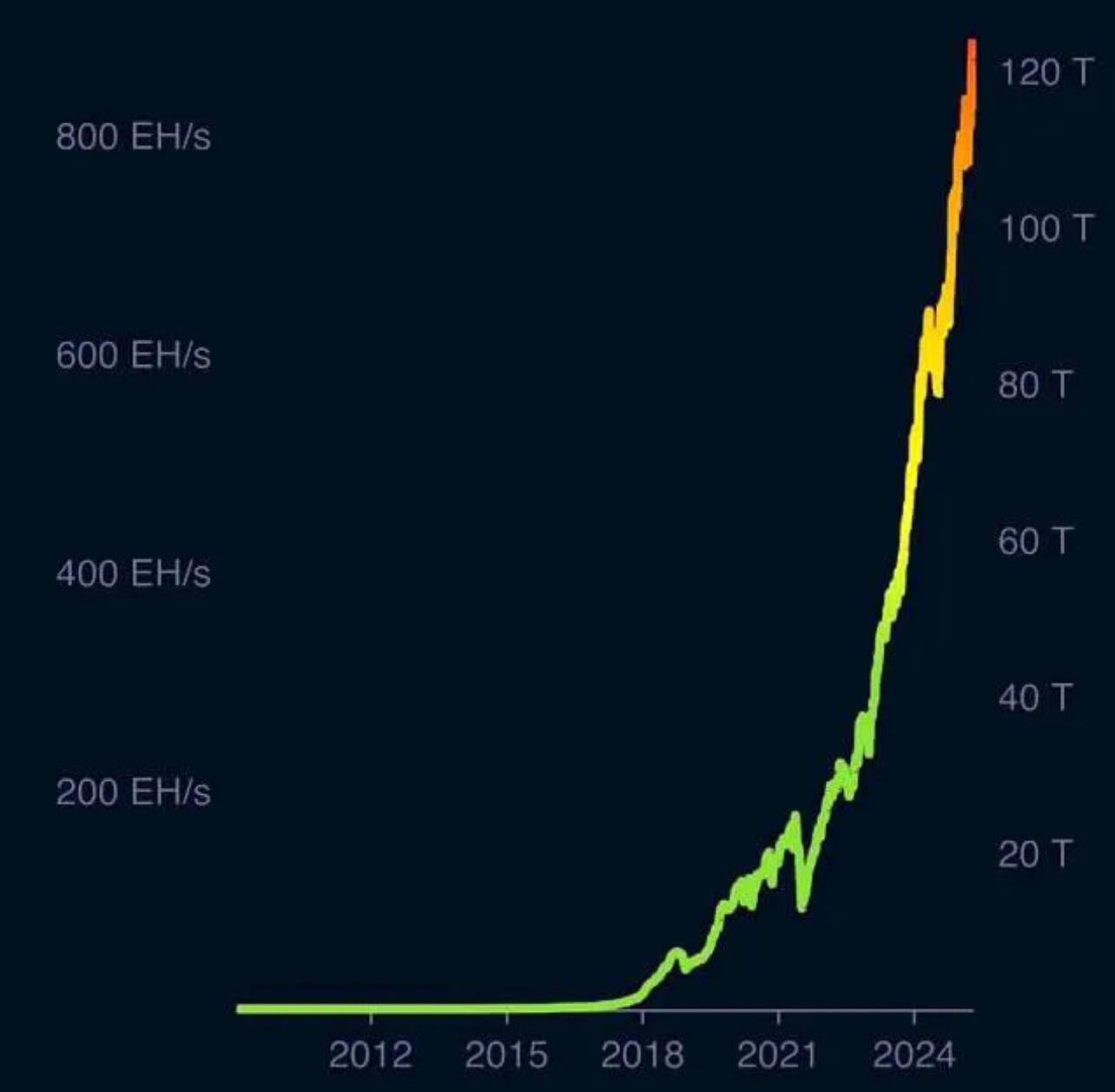

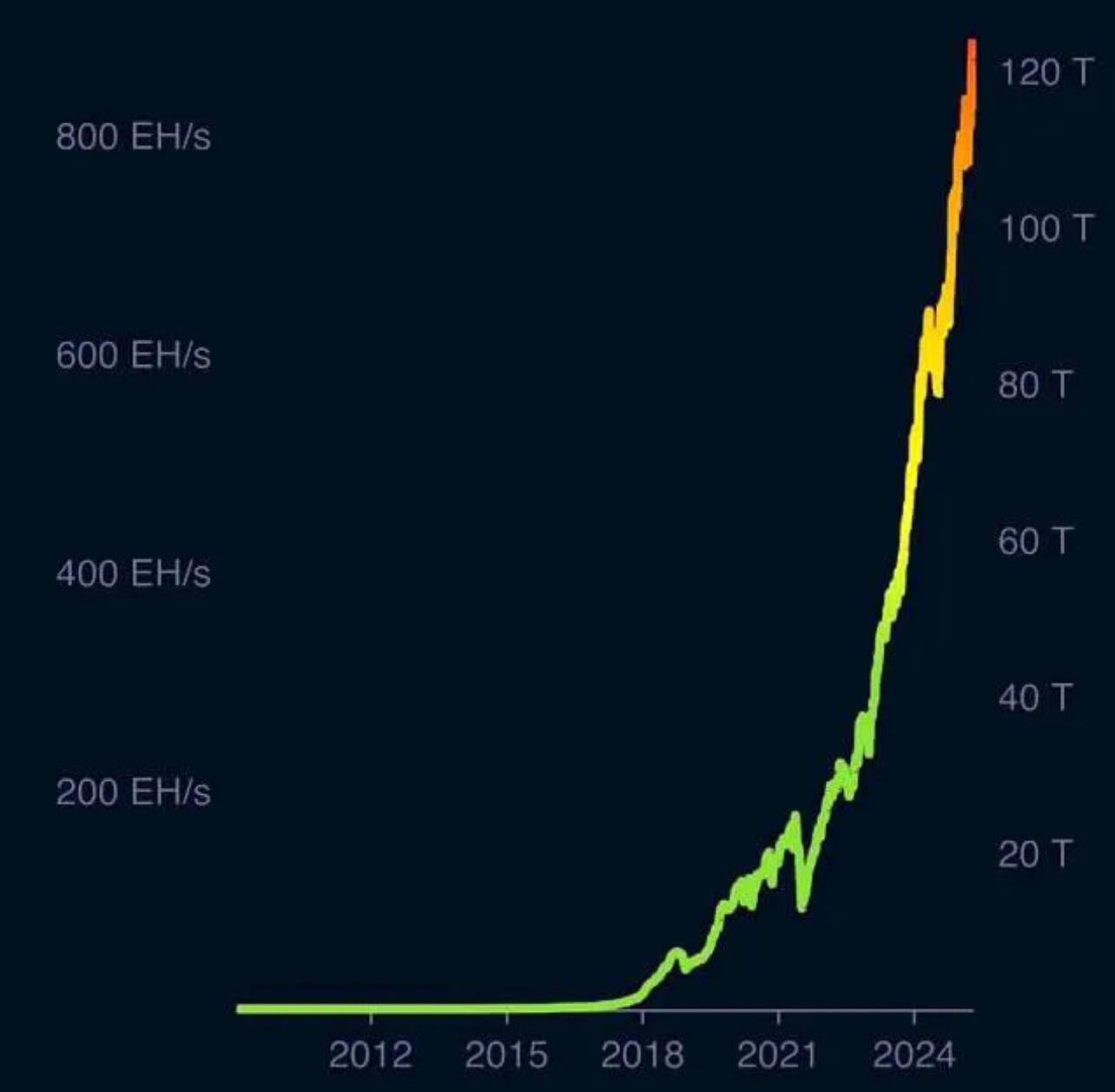

BREAKING: #Bitcoin Hahsrate MOONING.

18eab969:a6ccc0f0

posted

9 days ago

GM Nostr ☕️! I’m off to the fiat mines to convert unbacked fiat into the apex collateral. Stack #bitcoin and have a blessed day!

8d9d2b77:86dd65fa

posted

9 days ago

Good morning nostr, its raining again this morning, a welcome sound for us, as it was getting pretty parched around here. Today, depending on the weather, i want to throw some more hay in the chicken run, and maybe make a small compost bin for them, inside the run. And i have lots of computer stuff i need to work on, in case it keeps raining. There are so many more start9 apps on their marketplace that i want to explore, but first i just want to organize some stuff. Anyway, yall have a great tuesday, enjoy your coffee, and do your work with a happy heart. #coffeechain #homesteading #grownostr

QW

posted

9 days ago

The PCR episode with nostr:nprofile1qqszg7aht894g63cuypqcagssvv9yc5hnsnv8qmwceqgke27maqa08cpz3mhxue69uhkummnw3ezummcw3ezuer9wcq3vamnwvaz7tmjv4kxz7fwwpexjmtpdshxuet5vz2zal and Noa Gruman of nostr:nprofile1qqsrztgql26gvryk0jvtk3v9judtr0hegaw4rd97e0ylxyledpqr72cprpmhxue69uhhqun9d45h2mfwwpexjmtpdshxuet5aq068t is on its second week trending via nostr:nprofile1qqsx2wyjt6lmvc05rrvv05r5hm3w3t7h0pcpmkyswrpd4ymd2u09tscpr4mhxue69uhkummnw3ez6ur4vgh8wetvd3hhyer9wghxuet5qydhwumn8ghj7mn0wd68yvfww36kumn9d3ekzarn9e3k7mgyeaz50

We felt this show was special and our gut instinct did not disappoint.

nostr:nprofile1qqstsw3gkljwt5stm9svt7htvcjlj4ffze4chkcyt4pxxj30xkgeg5qpzemhxue69uhhyetvv9ujumn0wd68ytnzv9hxgqgcwaehxw309ac8yetdd96k6tnswf5k6ctv9ehx2aq4kth0y and I once again thank you gentle plebs for showing support for the cultural revolution. ✊🏼

https://fountain.fm/episode/gdBHcfDgDXEgALjX7nBu

98a7e3f6:15e18646

posted

9 days ago

Mexican Billionaire Ricardo Salinas: Investing in Real Estate Is ‘Bullshit,’ Buy Bitcoin Instead - Ricardo Salinas Pliego, the fifth-largest billionaire in Mexico, has offered major... - https://news.bitcoin.com/mexican-billionaire-ricardo-salinas-investing-in-real-estate-is-bullshit-buy-bitcoin-instead/ #bitcoin(btc) #newsbytes #mexico

f9dac64c:beee3002

posted

9 days ago

อนุสาวรีย์ #Bitcoin แห่งแรกของโลก !!! ประเทศสโลวีเนียได้สร้าง "วงเวียนรูปสัญลักษณ์ #BTC ขึ้นมาจากเสียงเรียกร้องของประชาชน" 🥰

.

วงเวียนนี้ถูกออกแบบเป็นสัญลักษณ์รูปตัว "B" ซึ่งขีดทับด้วยเส้นแนวตั้ง 2 เส้น (เหมือนโลโก้ Bitcoin นั่นเอง) เป็นการตั้งใจสื่อถึงทั้ง #BTC ที่เป็นพี่ใหญ่ และยังเป็นตัวแทนของเทคโนโลยีบล็อคเชนที่สนับสนุนสกุลเงิน Cryptocurrency ทั้งหลายด้วย (เขาว่าแบบนั้น55555) 🤔

.

นายกเทศมนตรี Bostjan Trilar ได้กล่าวให้สัมภาษณ์กับทางสำนักข่าวรอยเตอร์ว่า “เราได้ขอให้ประชาชนช่วยกันตัดสินใจผ่านเพจบน Facebook ว่าจะวางอะไรลงในวงเวียนใหม่อันนี้ดี และไอเดียนี้ก็เป็นหนึ่งในแนวคิดแรก ๆ ที่เราได้รับ... เมืองครานจ์ (Kranj) ของเราก็มีบริษัทมากมายที่เกี่ยวข้องกับเทคโนโลยีล้ำสมัยซะด้วย...” 🌐

.

งานประติมากรรมโลหะทรงกลมนี้มีน้ำหนักถึง 3 ตัน และมีเส้นผ่านศูนย์กลางประมาณ 7 เมตร ใหญ่เอาเรื่่องเลยนะสหาย ⛏

.

วงเวียนยักษ์นี้ถูกตั้งอยู่ใกล้กับศาลในเมืองครานจ์ ซึ่งอยู่ห่างจากเมืองหลวงลูบลิยานา (Ljubljana) ไปทางเหนือประมาณ 30 กิโลเมตร 🗺

.

บริษัทท้องถิ่นสองแห่งที่ใช้เทคโนโลยีบล็อกเชนได้รับทุนในการสร้างจากบริษัทท้องถิ่นสองแห่งที่ใช้เทคโนโลยีบล็อกเชน ได้แก่ บริษัทซอฟต์แวร์ 3fs และกระดานแลกเปลี่ยนสกุลเงินดิจิทัล Bitstamp นั่นเองงง... ⚙

.

อันนี้ไม่ใช่ของใหม่อะไรนะสหาย ความจริงวงเวียนนี้ถูกสร้างขึ้นมาเกิน 7 ปีแล้ว เพียงแต่ข้านำข้อมูลมาแบ่งปันให้พวกเจ้าได้อ่านกันเพื่อความเพลิดเพลิน (มั้ง ???) เฉย ๆ ว๊าาาฮ่า ๆ ๆ ๆ !!! 🧙♂️

.

#พ่อมดคริปโต #siamstr

อนุสาวรีย์ #Bitcoin แห่งแรกของโลก !!! ประเทศสโลวีเนียได้สร้าง "วงเวียนรูปสัญลักษณ์ #BTC ขึ้นมาจากเสียงเรียกร้องของประชาชน" 🥰

.

วงเวียนนี้ถูกออกแบบเป็นสัญลักษณ์รูปตัว "B" ซึ่งขีดทับด้วยเส้นแนวตั้ง 2 เส้น (เหมือนโลโก้ Bitcoin นั่นเอง) เป็นการตั้งใจสื่อถึงทั้ง #BTC ที่เป็นพี่ใหญ่ และยังเป็นตัวแทนของเทคโนโลยีบล็อคเชนที่สนับสนุนสกุลเงิน Cryptocurrency ทั้งหลายด้วย (เขาว่าแบบนั้น55555) 🤔

.

นายกเทศมนตรี Bostjan Trilar ได้กล่าวให้สัมภาษณ์กับทางสำนักข่าวรอยเตอร์ว่า “เราได้ขอให้ประชาชนช่วยกันตัดสินใจผ่านเพจบน Facebook ว่าจะวางอะไรลงในวงเวียนใหม่อันนี้ดี และไอเดียนี้ก็เป็นหนึ่งในแนวคิดแรก ๆ ที่เราได้รับ... เมืองครานจ์ (Kranj) ของเราก็มีบริษัทมากมายที่เกี่ยวข้องกับเทคโนโลยีล้ำสมัยซะด้วย...” 🌐

.

งานประติมากรรมโลหะทรงกลมนี้มีน้ำหนักถึง 3 ตัน และมีเส้นผ่านศูนย์กลางประมาณ 7 เมตร ใหญ่เอาเรื่่องเลยนะสหาย ⛏

.

วงเวียนยักษ์นี้ถูกตั้งอยู่ใกล้กับศาลในเมืองครานจ์ ซึ่งอยู่ห่างจากเมืองหลวงลูบลิยานา (Ljubljana) ไปทางเหนือประมาณ 30 กิโลเมตร 🗺

.

บริษัทท้องถิ่นสองแห่งที่ใช้เทคโนโลยีบล็อกเชนได้รับทุนในการสร้างจากบริษัทท้องถิ่นสองแห่งที่ใช้เทคโนโลยีบล็อกเชน ได้แก่ บริษัทซอฟต์แวร์ 3fs และกระดานแลกเปลี่ยนสกุลเงินดิจิทัล Bitstamp นั่นเองงง... ⚙

.

อันนี้ไม่ใช่ของใหม่อะไรนะสหาย ความจริงวงเวียนนี้ถูกสร้างขึ้นมาเกิน 7 ปีแล้ว เพียงแต่ข้านำข้อมูลมาแบ่งปันให้พวกเจ้าได้อ่านกันเพื่อความเพลิดเพลิน (มั้ง ???) เฉย ๆ ว๊าาาฮ่า ๆ ๆ ๆ !!! 🧙♂️

.

#พ่อมดคริปโต #siamstr

3d2e5150:8d51d594

posted

9 days ago

Have you looked at the mining centralization chart? If that’s not cause for concern I dunno what is.

2a98d5d9:1ef3da66

posted

9 days ago

„Was ist Proof of Work auf dem Tennisplatz?“

🔶 Bitcoin-Dämpfer

🎾 Zahlung via Lightning

📢 Boost gerne weiter, wenn du’s feierst!

#bitcoin #tennis #proofofwork #bitcointennis

3d2e5150:8d51d594

posted

9 days ago

Thank you for asking good questions!

8a387a3b:b46edfe9

reacted

9 days ago

+

0ab915c9:bc2ae379

reacted

9 days ago

+

Yeah. I was gonna get a creality but the guy at the store talked me out of it as I don't really want to babysit a machine and spend excess time on it. The Bambu Lab printers give a lot of bang for your buck.

If you haven't already, get yourself a dryer box for the filament. I just got a basic one where I can do 2 rolls at a time.

8d9d2b77:86dd65fa

posted

9 days ago

Gm, that'll be my next thing😊☕

9ce93661:44d63154

posted

9 days ago

#Natalie #Brunell #Jack #Mallers have a great conversation about #Bitcoin older video yet it still hits home

natalie@primal.net and jackmallers@primal.net

https://youtu.be/eDSZYLyYrdk

101b30ee:18a46a45

reposted

9 days ago

{"id":"29d6e1eea800fb0e3128dec3a26fddb0181c38b8264b897b0002cc55282546e3","kind":1,"content":"心が汚れているみなさん\nhttps:\/\/www.fnn.jp\/articles\/-\/867436","pubkey":"2c7cc62a697ea3a7826521f3fd34f0cb273693cbe5e9310f35449f43622a5cdc","created_at":1746530373,"sig":"3123c101f8ef65ec9e204e0d809e25532e27314556939c8177ea325c79a80083a5a63fa6c68f86272b76684d8dc137d9c67caac8bf9491a402c34ba23cb81677","tags":[["r","https:\/\/www.fnn.jp\/articles\/-\/867436"]]}

7460b7fd:4fc4e74b

posted

9 days ago

仅仅需要10元人民币,既可以破解黄金的埋藏。

#bitcoin is safer.

f40832e2:bcbf511e

reposted

9 days ago

{"kind":1,"pubkey":"2c7cc62a697ea3a7826521f3fd34f0cb273693cbe5e9310f35449f43622a5cdc","sig":"3123c101f8ef65ec9e204e0d809e25532e27314556939c8177ea325c79a80083a5a63fa6c68f86272b76684d8dc137d9c67caac8bf9491a402c34ba23cb81677","created_at":1746530373,"content":"心が汚れているみなさん\nhttps:\/\/www.fnn.jp\/articles\/-\/867436","id":"29d6e1eea800fb0e3128dec3a26fddb0181c38b8264b897b0002cc55282546e3","tags":[["r","https:\/\/www.fnn.jp\/articles\/-\/867436"]]}

OΞHI ⚡️🧡

posted

9 days ago

Pamp it

Whales And Minnows Swimming To Gold

Whales And Minnows Swimming To Gold

https://vongreyerz.gold/whales-and-minnows-swimming-to-gold

Many, from Elliot Wave experts to the dollar-hugging faithful, are asking if we are now https://vongreyerz.substack.com/p/has-gold-peaked-2025-vs-2011

https://cms.zerohedge.com/s3/files/inline-images/orig_whales.jpg?itok=ve0IDAix

The evidence, and answer, is: No.

Our Currency, Our Problem

Gold has made massive price moves in 2025, touching $3500 just days ago and finally making headlines in a politicized world, media and financial system that has otherwise deliberately attempted to ignore and downplay gold for decades.

But can we really blame those silly little “experts” with political incapacities for honesty?

After all, rising gold is proof positive that a debt-soaked nation is in deep trouble, as its currency is no longer trusted, loved, used or wanted.

When the USA abandoned its golden chaperone in 1971 and began spending like a drunken sailor, its Treasury Secretary, John Connally, didn’t seem to care at all that the US had just welched on the rest of the world—a world which once trusted the gold-backed dollar promised to them in the Bretton Woods moment of 1944.

For Connally (as well as Nixon, Kissinger and countless other DC forked-tongues), the new mantra was “our currency your problem” as Uncle Sam enjoyed the “exorbitant privilege” of spending beyond its means, inflating its dollar and then exporting that inflation to the rest of the world via its world reserve currency powers.

But powers can weaken…

Too Broke to Bully

As Uncle Sam now reaches $37T in public debt, the rest of the world, having seen that same bully of a fiat dollar weaponized and indebted beyond rational levels, is no longer as interested as it once was.

In short, for America, it’s now “our dollar, our problem” as the world slowly turns its back on the once hegemonic USA, UST and USD– the distrust and https://vongreyerz.gold/golden-sense-in-a-world-of-nonsense

.

Equally evident are the desperate policy reactions from DC to make the dollar hegemonic again—from DOGE headlines and tariff distructions to even the tragic irony of https://www.youtube.com/watch?v=GBxJm5lD8Ww

In this era of a less trusted and demanded dollar and UST, the backdrop for gold couldn’t be stronger, and the argument for “peak gold” couldn’t be weaker.

Show & Tell

But rather than just tell you this, let us show you this.

Just over a year ago, in March of 2024, gold broke the 13-year baseline of a deep cup and handle formation and then promptly met (and surpassed) its first $3000 statistical target price.

Over the next 6-12 months, the technicals suggest gold hitting its next percentage target of $4000.

Naturally, this does not mean gold only goes in one permanent direction (technically, for example, it could pull-back to a 200-day moving average), but its secular direction North is now obvious at both technical and fundamental levels.

As to those pesky (and far more telling) fundementals, gold will rise for the singular reason that fiat money will continue to fall in the backdrop of the greatest global debt backdrop in the history of capital markets.

When one just looks at gold’s rising direction…

https://cms.zerohedge.com/s3/files/inline-images/image%20-%202025-05-05T122509.767.jpg?itok=U0wbVHJk

…it is literally nothing more than an inverse image of the fiat dollar’s falling direction:

https://cms.zerohedge.com/s3/files/inline-images/Picture-2%20%281%29.jpg?itok=UK_BAEEW

But to any who understand a https://www.youtube.com/watch?v=mOe5JTt_rvA&t=6s

, this is no surprise.

After all, when a nation gets too in debt, the only real tool left is to inflate that debt away via deliberate currency debasement. Hence the chart above.

And as to this debt reality…

https://cms.zerohedge.com/s3/files/inline-images/3-768x418.jpg?itok=zvFeFaGp

…it is https://vongreyerz.gold/marching-toward-a-liquidity-cliff

in play today—from inflation/deflation debates, DXY direction, recession denial and stock market risk to precious metal price direction.

The Whales Are Stacking

Such debt and currency dynamics are now fully understood by the global financial whales, which is why central banks have been net stacking gold over USTs since 2014 and nearly tripling their physical gold purchasing since the https://vongreyerz.gold/how-the-west-was-lost-declining-world-reserve-currency

:

https://cms.zerohedge.com/s3/files/inline-images/4-768x435.jpg?itok=cXl4So2Z

This is also why whales like the BIS declared gold a Tier-1 strategic reserve asset in 2023 and it further explains why the whales have been taking https://vongreyerz.gold/comex-flows-is-the-gold-case-almost-too-obvious

at record levels since November of 2024.

And when it comes to the https://vongreyerz.gold/brics-vs-trump-whose-the-real-sucker

, the golden writing on the wall could not be clearer.

In short: The whales know that gold is far superior to a bankrupt Uncle Sam’s UST/USD as a future reserve asset.

Such whale purchasing of gold explains gold’s historic price moves of late and further explains why we are years (and thousands of dollars) away from anything at all resembling “peak gold.”

And Now the Minnows Are Catching On

Another key, yet largely ignored factor in confirming the longer-term direction (rather than current “peak”) of gold is that the minnows (i.e. retail markets) have only just begun to see the same writing on the wall of gold’s real use and future price direction.

That is, just as gold made a major technical breakout in March of last year, in March of THIS year, we saw another major breakout which, of course, the media is not covering at all…

Specifically, we just saw gold breaking away from a 10-year base in the classic/traditional 60/40 stock bond portfolio, which is the very bread & butter of consensus-think retail investment (mal) advisory narratives.

Stated otherwise, retail investors are catching on that inflated stocks and bonds aren’t what they used to be and that gold is more than just a pet rock.

The New Safe Haven

This rising retail understanding/move, coupled with the aforementioned “whale” moves in gold, bodes very well for its longer-term price and direction.

Much of this evolving awareness among retail investors hinges upon the devolving role of bonds as a once-sacred “safe haven” from stock market risk.

Even Bloomberg’s experts see the S&P’s fair valuation at below 4000.

In other words, stocks are in a massive bubble.

Buffett knows it. He’s hundreds of billions in cash and the last time we saw a stock market cap to GDP ratio (>200%) this high was in the US of 1929 or the Nikkei of 89.

And we all know how that played out…

But where to hide?

As we saw in 2020, and then again just weeks ago when the VIX surpassed 60 and stocks were falling, bonds were falling as well—which is a major warning of uh-oh.

In fact, we are now in a secular bear market for bonds, something not seen since the mid-1960’s to 1980, which means investors—both minnows and whales—need a better store of value than paper promises from broke(n) sovereigns.

In short, and to repeat: Gold is that new asset and that new direction, and is not even close to peaking.

Instead, gold’s climb is just beginning.

https://cms.zerohedge.com/users/tyler-durden

Tue, 05/06/2025 - 07:20

https://www.zerohedge.com/precious-metals/whales-and-minnows-swimming-gold

2c7cc62a:622a5cdc

posted

9 days ago

心が汚れているみなさん

https://www.fnn.jp/articles/-/867436

3492dd43:1af4ffdd

posted

9 days ago

👀