1d6dbcea:7d3fa66f

reacted

3 days ago

:This:

1d6dbcea:7d3fa66f

reacted

3 days ago

🫂

c0e0fdf2:9dca1663

posted

3 days ago

the internet is no longer exciting .. 😁

3a06add3:a0683a84

posted

3 days ago

first rugg?

6681268a:1c6752d9

posted

3 days ago

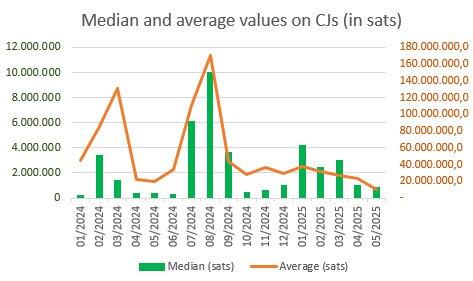

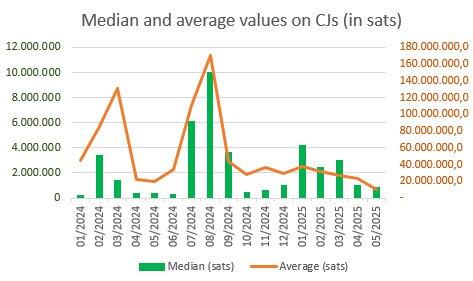

Joinmarket stats for May 2025

https://image.nostr.build/89a817023d3f169788c370af6d5f2b705cf1732056dc8ac0813d49a26dd1cf78.jpg

ff2e4123:cacb9ecd

reacted

3 days ago

:leolaugh:

ff2e4123:cacb9ecd

reacted

3 days ago

:PepeLaugh:

df5b213d:b08a9ba1

reacted

3 days ago

❗️

00000000:fa931856

reacted

3 days ago

:trippywhoa_sm:

98de3e4c:849315e5

posted

3 days ago

小仙女写耽美跟我看百合是一个心态吗

11c43c3d:2faf7ba4

posted

3 days ago

😅This child, so small and already so intelligent!😎🧡

https://blossom.primal.net/a43d8f58ed3ec20c8360ae66cac0c4fe09d8cc1bad73ce411c0dd54473435fc7.mp4

e9eac0e9:312ec453

posted

3 days ago

nostr:nprofile1qqswum4p82uluhz2dr40nvdrflspffntgqghc58w9fs57nx6jkdkuaqpzpmhxue69uhkummnw3ezuamfdejsz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqyt8wue69uhhxarjd93kstnvda3kzmp6xsurgwqjtv40v do you know why it ses amethyst is in beta because my phone sed that on the google playstore

e9eac0e9:312ec453

posted

3 days ago

#nostr dose anyone know why it ses on my phone that amethyst is in beta it's got me confused

omarvgws

posted

3 days ago

Ein Album mit 32 Fotos, ein schöner Ort 🫶🏽 Möchtest du ein Blick werfen? Sende mir eine PN 😉

Ein Album mit 32 Fotos, ein schöner Ort 🫶🏽 Möchtest du ein Blick werfen? Sende mir eine PN 😉

06b7819d:d1d8327c

posted

3 days ago

Article of the day: the high seas of finance are gonna get rough. Be ready!

New and untested

The Economist (North America)

May 31, 2025

American finance is exceptional. Under Donald Trump, it is also exceptionally dangerous

ALWAYS A HAVEN in dangerous times, America has itself become a source of instability. The list of anxieties is long. Government debt is rising at an alarming pace. Trade policy is beset by legal conflicts and uncertainties. Donald Trump is attacking the country’s institutions (see Leader). Foreign investors are skittish and the dollar has tumbled. Yet, astonishingly, one big danger lurks unnoticed still.

When you think of financial risk, you may picture investment-banking capers on Wall Street or subprime mortgages in Miami. But, as our special report explains, over the past decade American finance has been transformed. A mix of asset managers, hedge funds, private-equity firms and trading firms—including Apollo, BlackRock, Blackstone, Citadel, Jane Street, KKR and Millennium—have emerged from the shadows to elbow aside the incumbents. They are fundamentally different from the banks, insurers and old-style funds they have replaced. They are also big, complex and untested.

The financial revolution is now encountering the MAGA revolution. Mr Trump is hastening the next financial crisis by playing havoc with trade, upending America’s global commitments and, most of all, by prolonging the government’s borrowing binge. America’s financial system has long been dominant, but the world has never been as exposed to it. Everyone should worry about its fragility.

The new firms are a magnet for financial talent. They also enjoy regulatory advantages, because governments forced banks to hold more capital and rein in their traders after the financial crisis of 2007-09. That combination has led to a spate of innovation, supercharging the firms’ growth and propelling them into every corner of finance.

Three big private-markets firms, Apollo, Blackstone and KKR, have amassed $2.6trn in assets, almost five times as much as a decade ago. In that time the assets of large banks grew by just 50% to $14trn. In the search for stable funding, the upstarts have turned to insurance; Apollo, which made its name in private equity and merged with its insurance arm in 2022, now issues more annuities than any other American insurer. The firms lend to households and blue-chip companies such as Intel. Apollo alone lent $200bn last year. Loans held by large banks increased by just $120bn. New-look trading firms dominate stockpicking and marketmaking. In 2024 Jane Street earned as much trading revenue as Morgan Stanley.

There is much to like about this new financial system. It has been highly profitable. In some ways, it is also safer. Banks are vulnerable to runs because depositors fear being the last in the queue to withdraw their money. All things being equal, finance is more stable when loans are financed by money that is locked up for longer periods.

Most importantly, the dynamism of American finance has channelled capital towards productive uses and world-beating ideas, fuelling its economic and technological outperformance. The artificial-intelligence boom is propelled by venture capital and a new market for data-centre-backed securities. Bank-based financial systems in Europe and Asia cannot match America’s ability to mobilise capital. That has not only set back those regions’ industries, it has also drawn money into America. Over the past decade, the stock of American securities owned by foreigners doubled, to $30trn.

Unfortunately, the new finance also contains risks. And they are poorly understood. Indeed, because they are novel and untested by a crisis, they have never been quantified.

One lot of worries come from within the system. The new giants are still bank-like in surprising ways. Although it is costly to redeem a life-insurance policy early, a run is still possible should policy holders and other lenders fear that the alternative is to get back nothing. And although the banks are safer, depositors are still exposed to the new firms’ risk-taking. Bank loans to non-bank financial outfits have doubled since 2020, to $1.3trn. Likewise, the leverage supplied to hedge funds by banks has ballooned from $1.4trn in 2020 to $2.4trn today.

The new system is also dauntingly opaque. Whereas listed assets are priced almost in real time, private assets are highly illiquid. Mispriced risks can be masked until assets are suddenly revalued, forcing end investors to scramble to cover their losses. Novel financial techniques have repeatedly blown up in the past because financial innovators are driven to test their inventions to breaking-point and, the first time round, that threshold is unknown.

Under Mr Trump, the next upheaval is never far away. The government’s excessive borrowing imperils bond markets, alarming foreign investors. Although a court has this week limited the president’s powers to wage trade wars (see Finance & economics section), the administration is appealing and Mr Trump is unlikely to abandon tariffs altogether. A toxic combination of uncertainty, institutional conflict, volatile asset prices, higher capital costs and economic weakness threatens to put the new-look financial system under almighty strain.

A crisis would test even the most capable policymaker. Much about the risks of the superstar firms, and their linkages to the wider financial system and the real economy, will become clear only when trouble strikes. New emergency-lending schemes would be needed. Rescuing banks last time was politically toxic. Saving billionaire investors would be an altogether harder task. And yet if the biggest of these giant firms were left to fail, it could lead to a global credit crunch.

Under Mr Trump a rescue would be unpredictable. In 2008 the Treasury and the Federal Reserve acted quickly to save the banks, and set up swap lines to offer dollar funding to much of the world. Mr Trump might decide to bail out everyone. But imagine the panic if he started to pick his favourite financiers, threatened to abandon or charge countries that displeased him and changed his mind every five minutes on Truth Social.

There will be another financial crisis—there always is. Nobody knows when disaster will strike. But when it does, investors will suddenly wake up to the fact that they are dealing with a financial system they do not recognise. ■

Shared via PressReader

connecting people through news

6c5fbbb2:620b9a71

reposted

3 days ago

{"id":"1197fbd8499e38550cc160eaa352ec8e401d3103cf5f4fb0487e741c190658e3","pubkey":"2f5de0003db84ecd5449128350c66c7fb63e9d02b250d84af84f463e2f9bcef1","created_at":1749033214,"kind":1,"tags":[["r","https://cdn.nostrcheck.me/2f5de0003db84ecd5449128350c66c7fb63e9d02b250d84af84f463e2f9bcef1/f157e841271cdf85365340409a20d882b059cfbe54cac20c55f72257e187a362.webp"],["r","https://cdn.nostrcheck.me/2f5de0003db84ecd5449128350c66c7fb63e9d02b250d84af84f463e2f9bcef1/0ffd0f1d9b5685c46140b341d50024e9125c58f96265225066d08fdd2e271015.webp"],["imeta","url https://cdn.nostrcheck.me/2f5de0003db84ecd5449128350c66c7fb63e9d02b250d84af84f463e2f9bcef1/0ffd0f1d9b5685c46140b341d50024e9125c58f96265225066d08fdd2e271015.webp","x 9bbc7446658e809571752f411ab44a0a2bc19e14ad331e2ac0b2786baf6bc627","size 89492","m image/jpeg","dim 695x960","blurhash _4QmCrxs%M?c_4_4?c00WBRjoft7axof00NKRkV@xsW9t600oKM{WCM|M|Rk00t2ocWFo#R.WF00a$WBWAf5Rjax00ohRkWAROW9M_00oIM_RkogRkRjD$avaxj]R.WFM|","ox 0ffd0f1d9b5685c46140b341d50024e9125c58f96265225066d08fdd2e271015","alt "],["imeta","url https://cdn.nostrcheck.me/2f5de0003db84ecd5449128350c66c7fb63e9d02b250d84af84f463e2f9bcef1/f157e841271cdf85365340409a20d882b059cfbe54cac20c55f72257e187a362.webp","x 8f79efa48f64f549a097bdbc2ce9ad847ba07d4fd9d458c59d10c1eb5f1e349a","size 57732","m image/jpeg","dim 478x960","blurhash ]7RMe=9Z~Wn~?bNHx]V?M_xu?H%2IUt7ogr=nhofR+t8-oRPR+tRRj?bt7R*WBo0?bxuIoxajZx]M{xaxuRj%gs:RjxuWV","ox f157e841271cdf85365340409a20d882b059cfbe54cac20c55f72257e187a362","alt "]],"content":"\"THERE WILL BE NO RE-HYPOTHICATION\".\n\nhttps://cdn.nostrcheck.me/2f5de0003db84ecd5449128350c66c7fb63e9d02b250d84af84f463e2f9bcef1/f157e841271cdf85365340409a20d882b059cfbe54cac20c55f72257e187a362.webp\n\nhttps://cdn.nostrcheck.me/2f5de0003db84ecd5449128350c66c7fb63e9d02b250d84af84f463e2f9bcef1/0ffd0f1d9b5685c46140b341d50024e9125c58f96265225066d08fdd2e271015.webp","sig":"2f76e6dadea730706571b902a6e629796387f708136b6208496171c42aa466854a085c2dab8980b3cef37729dedd229c35c9608c652328000303050f984fce1e"}

e1c2fa74:18d08857

posted

3 days ago

https://cdn.nostrcheck.me/e1c2fa746cc7d086a3ea5684840787f6eb460cd76735a88d7ee6d71418d08857/e3adb1450844e9968f32cd29ee9d7e51bbba28f46e50d243b6661efcdbee3557.webp

https://cdn.nostrcheck.me/e1c2fa746cc7d086a3ea5684840787f6eb460cd76735a88d7ee6d71418d08857/8d7e8eff255905d2ef2587e0653e919d6f194ab05869531b5d4a3f8681bc08dd.webp

https://cdn.nostrcheck.me/e1c2fa746cc7d086a3ea5684840787f6eb460cd76735a88d7ee6d71418d08857/e3adb1450844e9968f32cd29ee9d7e51bbba28f46e50d243b6661efcdbee3557.webp

https://cdn.nostrcheck.me/e1c2fa746cc7d086a3ea5684840787f6eb460cd76735a88d7ee6d71418d08857/8d7e8eff255905d2ef2587e0653e919d6f194ab05869531b5d4a3f8681bc08dd.webp

fa0165a0:03397073

posted

3 days ago

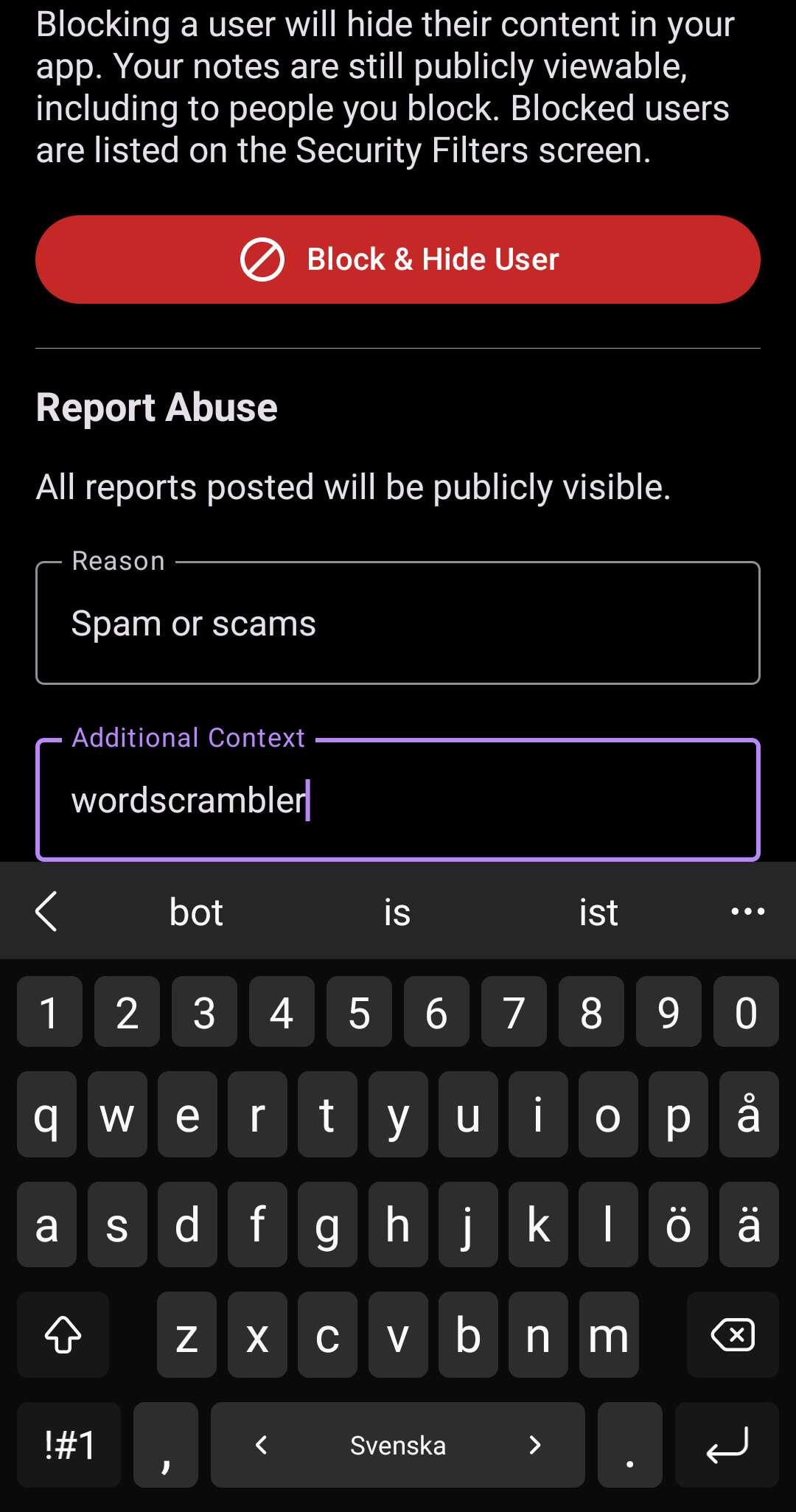

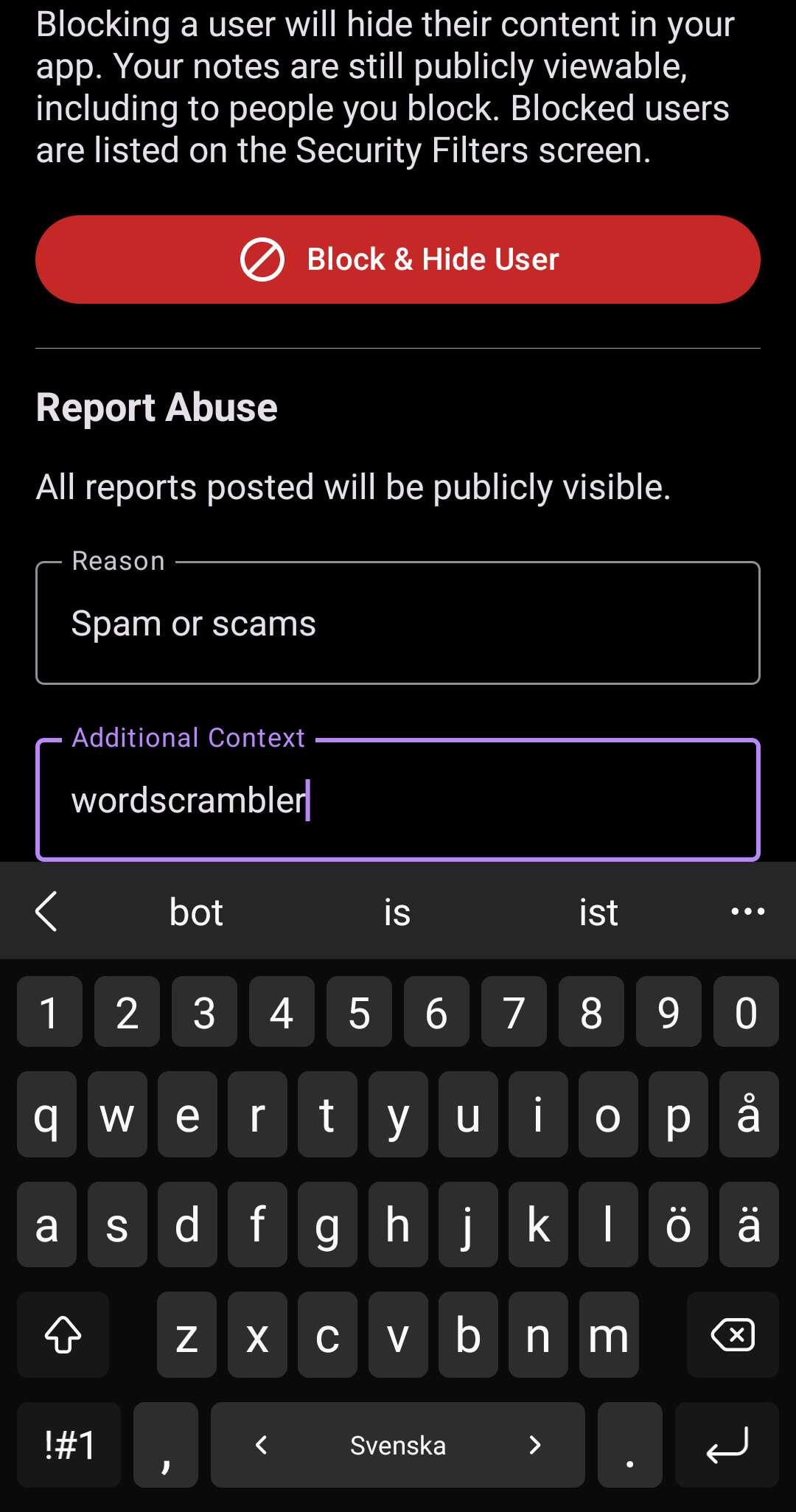

I recommend naming these bots "wordscrambler"s and reporting them. The name will help developers keep track on them to develop appropriate spam protections against them.

They are generally identified my their machine quick replies that have just rearranged the words in the note they replied to.

nostr:nevent1qqsgu8rnx2slx07js9wf53ax64jg3csmg5strtsldgwcvuls9m4tguqpz4mhxue69uhkummnw3ezummcw3ezuer9wchsygrpwuw5x25vfunurc0h0539dlctwc9ch4qdlslhpfvwzj3qfp6j3upsgqqqqqqsh74dq5

nostr:nevent1qqsgu8rnx2slx07js9wf53ax64jg3csmg5strtsldgwcvuls9m4tguqpz4mhxue69uhkummnw3ezummcw3ezuer9wchsygrpwuw5x25vfunurc0h0539dlctwc9ch4qdlslhpfvwzj3qfp6j3upsgqqqqqqsh74dq5

nostr:nevent1qqsgu8rnx2slx07js9wf53ax64jg3csmg5strtsldgwcvuls9m4tguqpz4mhxue69uhkummnw3ezummcw3ezuer9wchsygrpwuw5x25vfunurc0h0539dlctwc9ch4qdlslhpfvwzj3qfp6j3upsgqqqqqqsh74dq5

nostr:nevent1qqsgu8rnx2slx07js9wf53ax64jg3csmg5strtsldgwcvuls9m4tguqpz4mhxue69uhkummnw3ezummcw3ezuer9wchsygrpwuw5x25vfunurc0h0539dlctwc9ch4qdlslhpfvwzj3qfp6j3upsgqqqqqqsh74dq5

d8335653:061ba289

posted

4 days ago

Could you please share whats the reason for rewrite?

9358c676:9f2912fc

posted

4 days ago

Just to go to a bank and ask for a loan, then go to a casino and all in red un the roulette 😅🎲

d053ee45:4b96ccd9

posted

4 days ago

Get your Magic Mushroom T-Shirts Get your unique art-inspired designs featuring majestic lions on savannah landscapes at sunset #tshirt #fashion #clothing #lionsunited #wildlifeart #sunsetvibes #savannahstyle #naturelovers #ecofriendly

https://www.dezooyi.de/upload/HD_102_386721491697459_0001.jpg

4eb88310:2e055d6d

reposted

4 days ago

{"id":"beaf89f0e9250fd5b927402f8098d0422a541251e0c7d5c6b3075f198759938a","pubkey":"4eb88310d6b4ed95c6d66a395b3d3cf559b85faec8f7691dafd405a92e055d6d","created_at":1749012443,"kind":1,"tags":[],"content":"Who do I know in Saipan?","sig":"32d96acc79eef90639d4fbc2a3d1c730a54f06d205592c2e7e4e4a732221de1fbb81ae8fe8dfe001bdeca20b1457bf91d1ce418ab79e8e1afcd8f2816d7473c5"}

93eeb56c:9469e39a

posted

4 days ago

nostr:npub167n5w6cj2wseqtmk26zllc7n28uv9c4vw28k2kht206vnghe5a7stgzu3r app set. Already saw a bunch of you there. 🔥

4eb88310:2e055d6d

posted

4 days ago

She's a sweetheart... with bone crushers ;)

288e79dc:9f24caf7

posted

4 days ago

Hey I need to #asknostr for help. I’m putting a “zap me a coffee” button on my new website but I can’t work out how to change my details… it shows me as anonymous, and I’ve just got a new lightning wallet I want to link it to. I can’t find anywhere on zapmeacoffee.com where I can change that. #anyone? #zapmeacoffee