eaa2a77f:2c0a44b2

posted

5 days ago

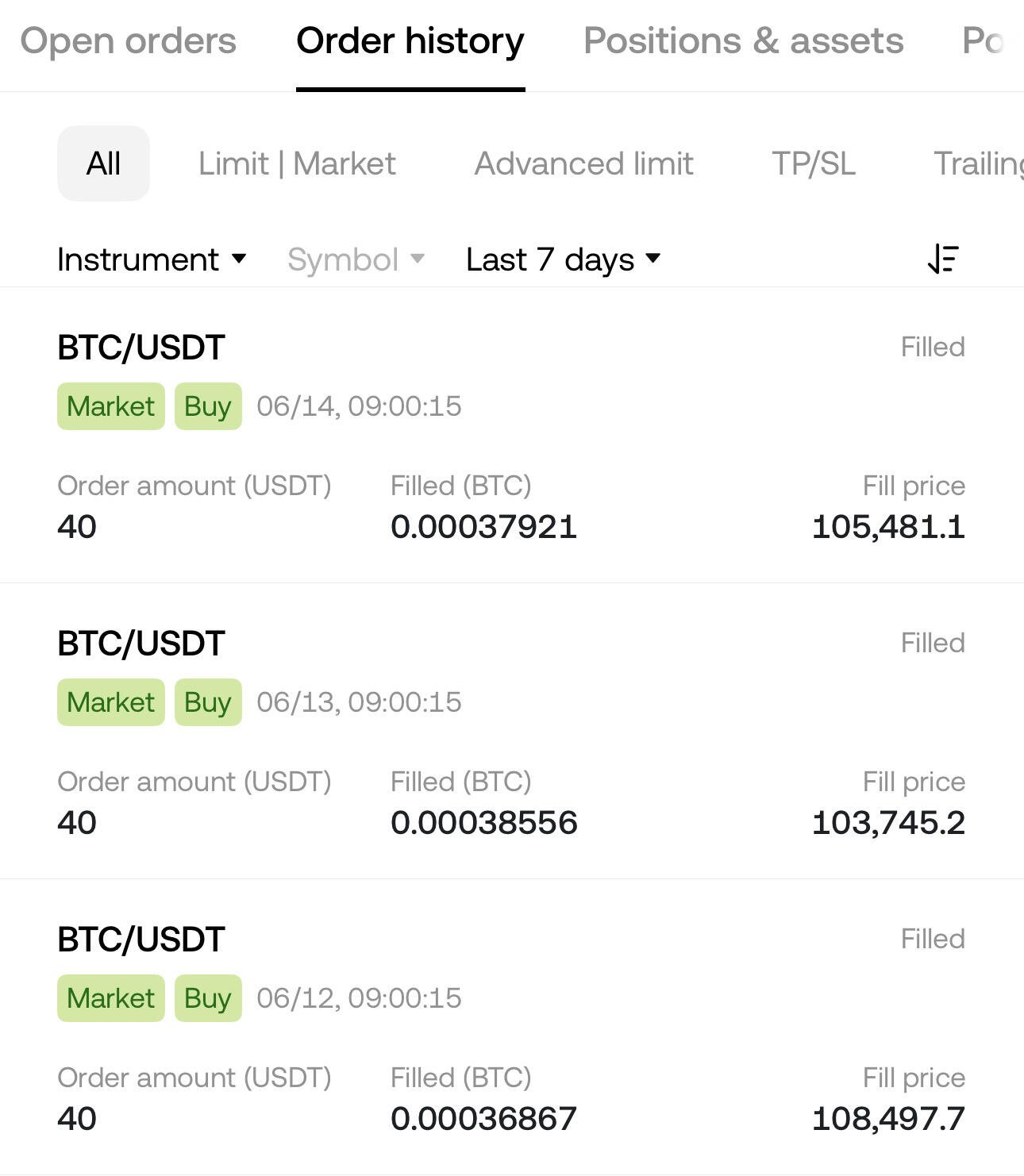

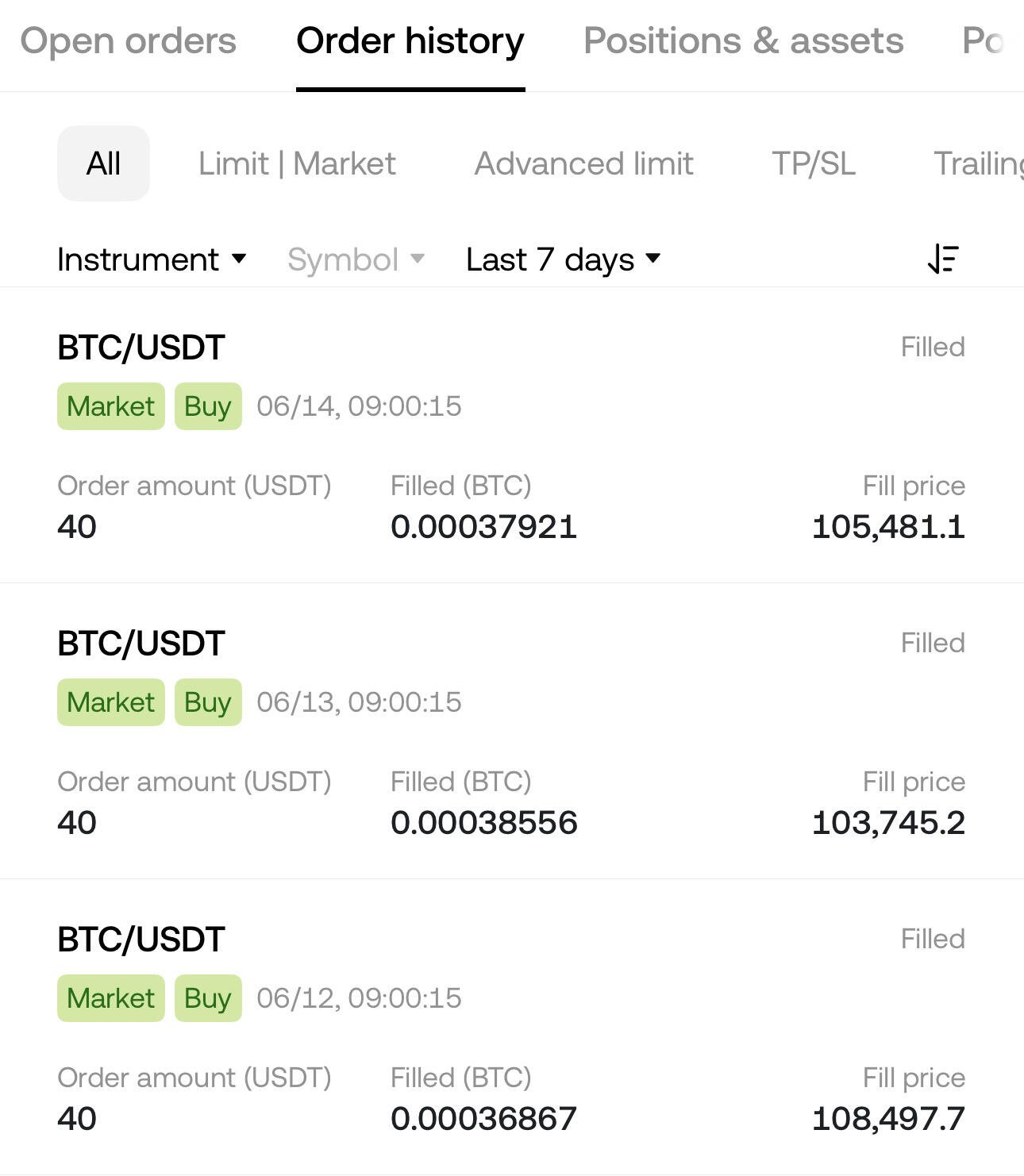

#day176 for dca BTC everyday

BTC 105,481 $

0.000379 BTC

#bitcoin #siamstr

1fa3ef27:63862cfe

posted

5 days ago

#SouthGate #bitcoin

https://x.com/thejenniwren/status/1933533149406880116

SerSleepy

posted

5 days ago

I’m 4hrs late /: no see anything

3731e169:85be0885

posted

5 days ago

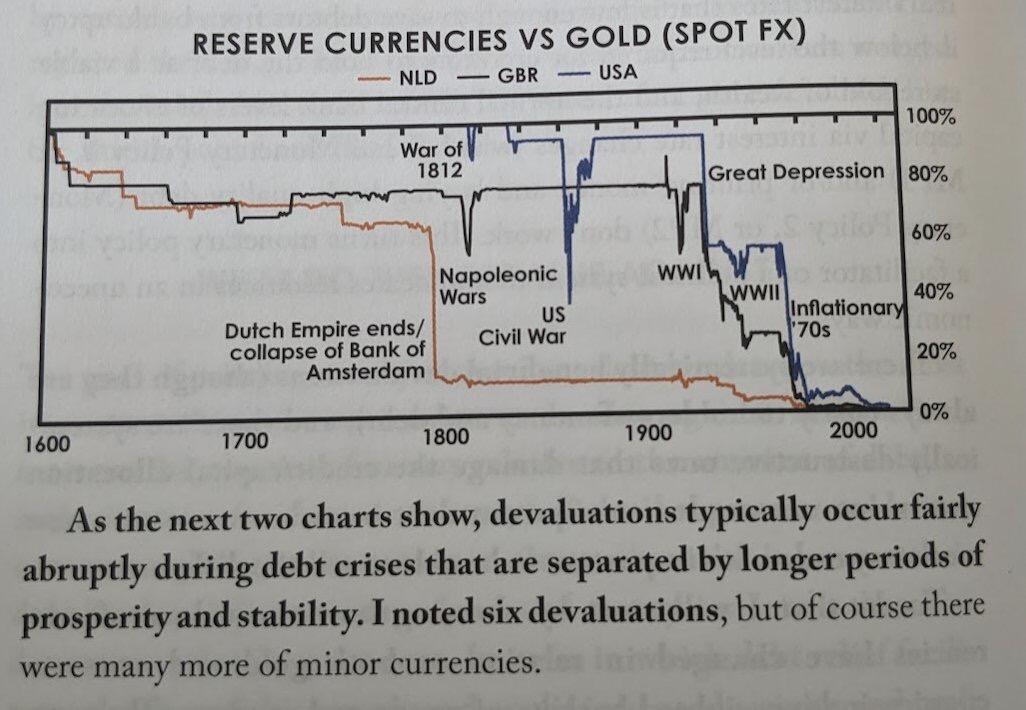

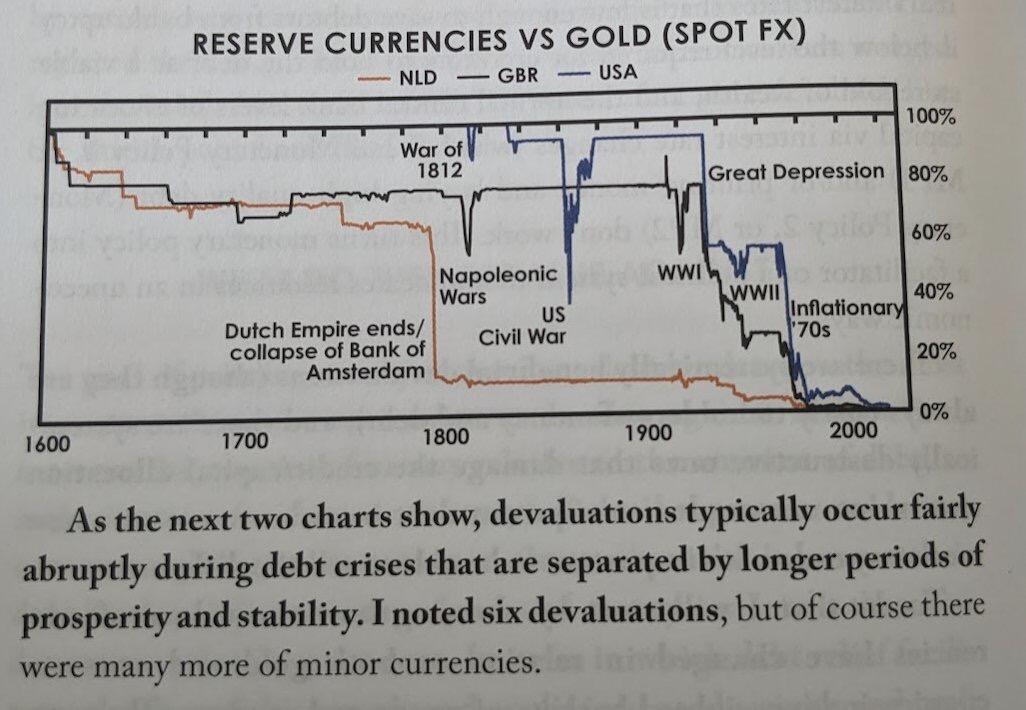

#21stCapital on Modern Monetary Reality

👇🏻

“The end of every single fiat monetary system has been confiscation and devaluation.

You won’t be able to access your ETFs nor any fiat instrument that the government can access.

The solution? COLD STORED BITCOIN with multi jurisdictional multisig and backup plans, which the government can NEVER cease even if they invade your home.”

“The Big Beautiful Devaluation is Coming

“Devaluations typically occur fairly abruptly during debt crises.”

Elon and Bessent both confirmed what we laid out in the Bitcoin Intelligence Playbook:

- DOGE was a distraction.

- Deficit reduction was a farce.

- And there is paying back the debt.

A new narrative is emerging. Now they’re saying the US will “grow its way out” of this debt spiral.

Let’s be clear, growing your way out of debt in real terms is impossible. This is code for "we’re going to inflate it away."

To grow out of this debt without spending cuts or tax increases, the U.S. would need real GDP growth of 20%+ per year for a decade to pay back the debt.

The only other solution is a nominal growth instead of real growth, i.e., inflation.

Hence, the "grow our way out" narrative is often shorthand for financial repression or stealth devaluation.

Translation: The dollar is being sacrificed and Treasuries will be repaid in devalued money.

The USG will soft-default on its debt.

Every reserve currency devaluation in the last 400 years happened suddenly.

Debt crisis hits, and boom—value evaporates.

“Devaluations typically occur fairly abruptly during debt crises.”

To protect yourself agains this devaluation you need a "counter-asset" to the US dollar: Bitcoin in self custody.

If a crisis occurs, you will realize that you actually don't own the Bitcoin in ETFs or treasury companies.

Own the cold hard bearer instrument.”

#bitcoin

https://image.nostr.build/e0592eefe33659c379a57f29f1d95c9847b015345ad7d428c3b60c450a5d9388.png

3731e169:85be0885

posted

5 days ago

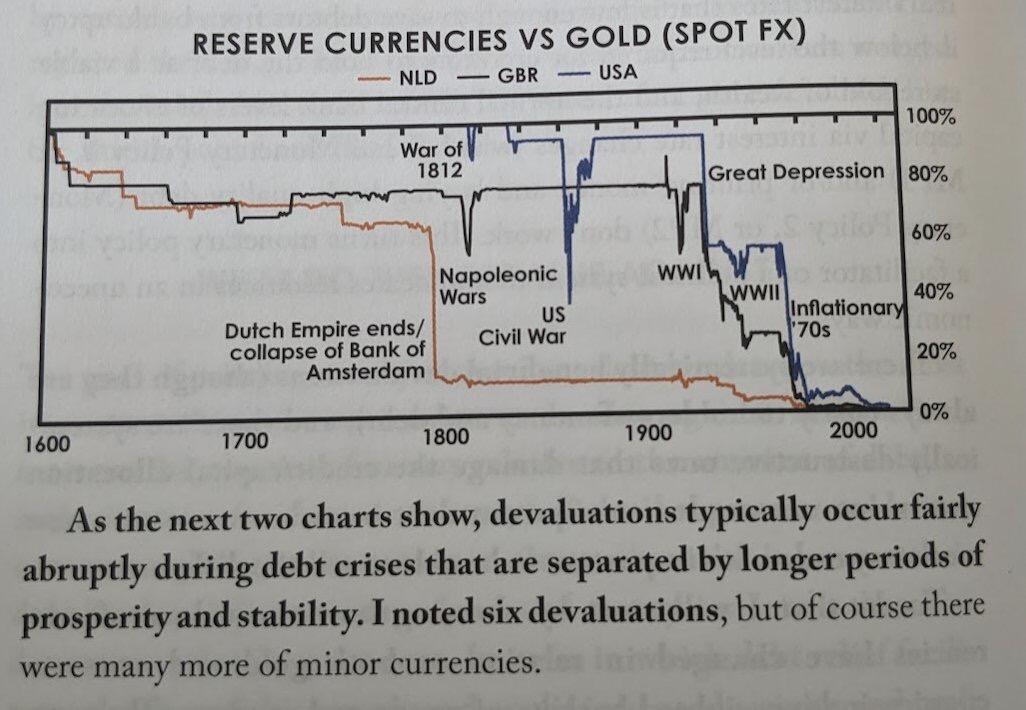

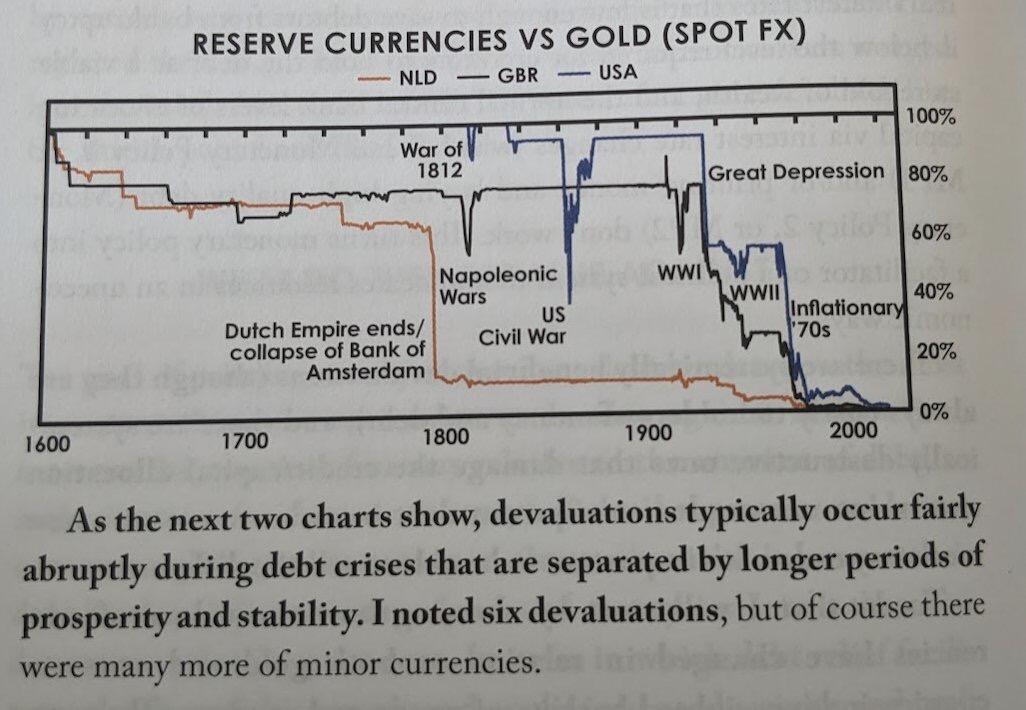

#21stCapital on Modern Monetary Reality

👇🏻

“The end of every single fiat monetary system has been confiscation and devaluation.

You won’t be able to access your ETFs nor any fiat instrument that the government can access.

The solution? COLD STORED BITCOIN with multi jurisdictional multisig and backup plans, which the government can NEVER cease even if they invade your home.”

“The Big Beautiful Devaluation is Coming

“Devaluations typically occur fairly abruptly during debt crises.”

Elon and Bessent both confirmed what we laid out in the Bitcoin Intelligence Playbook:

- DOGE was a distraction.

- Deficit reduction was a farce.

- And there is paying back the debt.

A new narrative is emerging. Now they’re saying the US will “grow its way out” of this debt spiral.

Let’s be clear, growing your way out of debt in real terms is impossible. This is code for "we’re going to inflate it away."

To grow out of this debt without spending cuts or tax increases, the U.S. would need real GDP growth of 20%+ per year for a decade to pay back the debt.

The only other solution is a nominal growth instead of real growth, i.e., inflation.

Hence, the "grow our way out" narrative is often shorthand for financial repression or stealth devaluation.

Translation: The dollar is being sacrificed and Treasuries will be repaid in devalued money.

The USG will soft-default on its debt.

Every reserve currency devaluation in the last 400 years happened suddenly.

Debt crisis hits, and boom—value evaporates.

“Devaluations typically occur fairly abruptly during debt crises.”

To protect yourself agains this devaluation you need a "counter-asset" to the US dollar: Bitcoin in self custody.

If a crisis occurs, you will realize that you actually don't own the Bitcoin in ETFs or treasury companies.

Own the cold hard bearer instrument.”

#bitcoin

https://image.nostr.build/e0592eefe33659c379a57f29f1d95c9847b015345ad7d428c3b60c450a5d9388.png

1fa3ef27:63862cfe

posted

5 days ago

#Atlanta #bitcoin

https://x.com/piyushmittal/status/1933675143580299646

SerSleepy

posted

5 days ago

How??

20986fb8:cdac21b3

posted

5 days ago

Nostr Workshop by YakiHonne & ABUDevs (developers) Community : Successfully Held! ✅

Event Highlights:

👥 Attendance: 24 engaged participants joined the session

🔗 Showcase: Introduce Nostr , Experience YakiHonne "Smart Widget+ Use Bitcoin Payments

🎁 Raffle: 2 lucky winners each received 5,000 sats—congrats! 🧡

🗓 More workshops are on the way—stay tuned for what’s next! nostr:nevent1qqsz0unch4enjmecfl5gha4mffynd4d30kn6amacp4ph9sgwkqxzdjccvdf0s

NunyaBidness

posted

5 days ago

It's so f'ing perfect.

fcf70a45:df67d37e

posted

5 days ago

The funny thing is that people like you get nervous when they don't hear what they want to hear. How many COVID vaccines did you get? I'm sure you got at least three, haha.

SerSleepy

posted

5 days ago

Sounds goood! They make you schedule a 10 min call with them so I guess I gotta wait til Monday but let’s see, hopefully this work 🙏🫂 thank you bro!!

fcf70a45:df67d37e

posted

5 days ago

The facilities attacked contained at least uranium, so they are just as polluting, right?

The: Daniel⚡️

posted

5 days ago

Why don’t you check out this one?

https://paywithflash.com/integrations/

fcf70a45:df67d37e

posted

5 days ago

I repeat, there is a lot of literature on the subject. There are two versions; believe whichever one you want.

AK

posted

5 days ago

joisus

32e442f1:89625a57

reacted

5 days ago

+

AK

posted

5 days ago

add more days

50c59a1c:6b0a027e

posted

5 days ago

😂😂

9b6d95b7:213285f5

posted

5 days ago

instal preparation for nostr:npub167n5w6cj2wseqtmk26zllc7n28uv9c4vw28k2kht206vnghe5a7stgzu3r

50c59a1c:6b0a027e

posted

5 days ago

Hey, I know him!

Morning 🥰

.

posted

5 days ago

af89d3b1:225adddf

posted

5 days ago

BlackRock ได้สะสม Bitcoin มากกว่า 3% ของอุปทานทั้งหมดของ Bitcoin ผ่านกองทุน iShares Bitcoin Trust (IBIT) โดยถือครองมากกว่า 662,500 BTC มูลค่าประมาณ 72.4 พันล้านดอลลาร์สหรัฐ ณ วันที่ 10 มิถุนายน 2025 ซึ่งทำให้ IBIT กลายเป็นผู้ถือ Bitcoin รายใหญ่เป็นอันดับสองรองจาก Satoshi Nakamoto และอาจกลายเป็นผู้ถือรายใหญ่ที่สุดในอนาคตอันใกล้หากการสะสมยังคงดำเนินต่อไป

การเข้ามาของ BlackRock ในตลาด Bitcoin สะท้อนถึงการเปลี่ยนแปลงในมุมมองของสถาบันที่มอง Bitcoin เป็นสินทรัพย์ที่เหมาะสมสำหรับการลงทุนระยะยาวและเป็นส่วนหนึ่งของพอร์ตการลงทุนที่หลากหลายมากขึ้น ส่งผลให้ Bitcoin ได้รับการยอมรับในวงกว้างมากขึ้นและกลายเป็นสินทรัพย์ที่มีความน่าเชื่อถือในสายตาของนักลงทุนสถาบัน

วันที่ข่าว: 10-13 มิถุนายน 2025

แหล่งข้อมูล: Cointelegraph, AInvest, CryptoDnes, CryptoSlate, Pintu News

#siamstr #btc #bitcoin #coinforce

e9c88d4e:e5552f50

posted

5 days ago

AI?

benthecarman

posted

5 days ago

Micro strategy is leveraged long bitcoin, nakamoto is leveraged long micro strategy

benthecarman

posted

5 days ago

Exactly what I'd say if I compromised someone's nsec