fcf70a45:df67d37e

posted

15 days ago

The world is once again a superpower struggle, China, Russia and the US are the kings of the board.

There are also secondary actors that are used and discarded like Europe or England, right now North Korea is already more important than these.

North Korea participates in the Ukrainian war contributing soldiers and technology, it has Lazarus the pirates of the XXI century and nuclear weapons, in Europe we have caps glued to bottles.

How the world has changed in just 10 years, I see it and I do not believe it.

Bitcoin is more necessary than ever, Bitcoin means neutrality, it means screw the system, it means I want to be the owner of my life, it means a better future for our children.

https://m.primal.net/QErR.mp4

80b2b76a:a972c5a8

posted

15 days ago

~~~~~~~~~~~~~~~~~~~~~

#Bitcoin BTC/SEK hourly price

~~~~~~~~~~~~~~~~~~~~~

1 BTC: 834,585 sek | 24hr: 2.16%

1 SEK: 119 sats

Market cap: 16,555,937,256,799 sek

Updated: 2025-04-05 | 09:02 CEST

GM frens

90fd5d46:cd475ff8

posted

15 days ago

~~~~~~~~~~~~~~~~~~~~~

#Bitcoin BTC/Gold hourly price

~~~~~~~~~~~~~~~~~~~~~

1 BTC: 27.48 oz | 24hr: 2.59%

1 oz Gold: 3,639,010 sats

Bitcoin marketcap: 1.7 trillion USD

Gold marketcap: 21.2 trillion USD

Bitcoin Vs Gold marketcap: 7.8%

Updated: 2025-04-05 | 07:00 UTC

9279276b:2baa0bcb

posted

15 days ago

The Man Out to Prove How Dumb AI Still Is

by co574 in ~AI

55 sats and 0 comments so far

https://stacker.news/items/934997

54609048:8e22ba03

posted

15 days ago

All your models are destroyed. This is why we #bitcoin

c5337187:a5f35224

posted

15 days ago

Bitcoin: 83411 USD

1 Satoshi = 0.00083411 USD

#bitcoin #crypto #price

#bitcoin #crypto #price

#bitcoin #crypto #price

#bitcoin #crypto #price

c5337187:a5f35224

posted

15 days ago

Bitcoin Price Action In Last 24 Hours:

Avg: 83573 USD

Min: 81714 USD

Max: 84631 USD

#bitcoin #trade

fcf70a45:df67d37e

posted

15 days ago

The EU initiative Going Dark has now been launched by the EU Commission. They call it ProtectEU.

It’s a rebranding of Chat Control. New name. Same old propaganda.

The EU Commission’s goal is to “access encrypted data in a lawful manner, safeguarding cybersecurity and fundamental rights.”

Read the full release from the Commission here:

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52025PC0148

fcf70a45:df67d37e

posted

15 days ago

It's all bullshit

From East to West and North to South.

Bitcoin and Liberty.

Karnage

posted

15 days ago

💯 framing makes all the difference

95e96e48:73bb1b5b

posted

15 days ago

https://www.youtube.com/live/qZVxlhbrdwA?si=lzz2q7TdJtpoHA12

#siamstr #bitcoin

fcf70a45:df67d37e

posted

15 days ago

By Arthur Hayes

THE END:

Of US Treasuries and to a lesser extent US stocks as the global reserve asset. Since Nixon took the US off the gold standard in 1971, US treasury debt outstanding grew by 85x. The US had to create the credit dollars necessary for the growth in the world economy. This was good for some Americans and bad for others. Trump was elected on average by those who believe they didn't share in the US "prosperity" of the last 50 years.

If the US current account deficit is eliminated, then foreigners do not have dollars to buy bonds and stocks. If foreigners have to juice up their own nations' economies they will sell what they own, US bonds and stocks, to fund their nation-first policies. And even if Trump backtracks on the severity of the tariffs, no finance minister or world leader can risk Trump changing his mind again, and therefore things cannot return to the way they were. You must do what is best for your country.

THE RETURN:

Of gold as the neutral reserve asset. The dollar will still be the reserve currency, but nations will hold reserves in gold to settle global trade. Trump hinted at this because gold is tariff exempt! Gold must flow freely and cheaply in the new world monetary order.

A lot of those who had it good are in the denial stage, and share a delusion that somehow things will return to "normal". Poppycock.

For those who want to adapt to a return to pre-1971 trade relationships, buy gold, gold miners and $BTC.

That's enough on tariff shit. My next essay will focus on why USDCNY is going to 10.00 bc there is no way that Xi Jinping will agree to change China in the ways necessary to placate Trump. This is the super bazooka $BTC needs to ascend rapidly towards $1 million.

0f389bba:9b3f148f

posted

15 days ago

🌊 SURF 'N TURF 🏝️

-THE BITCOIN BORACAY ISLAND LIFE-

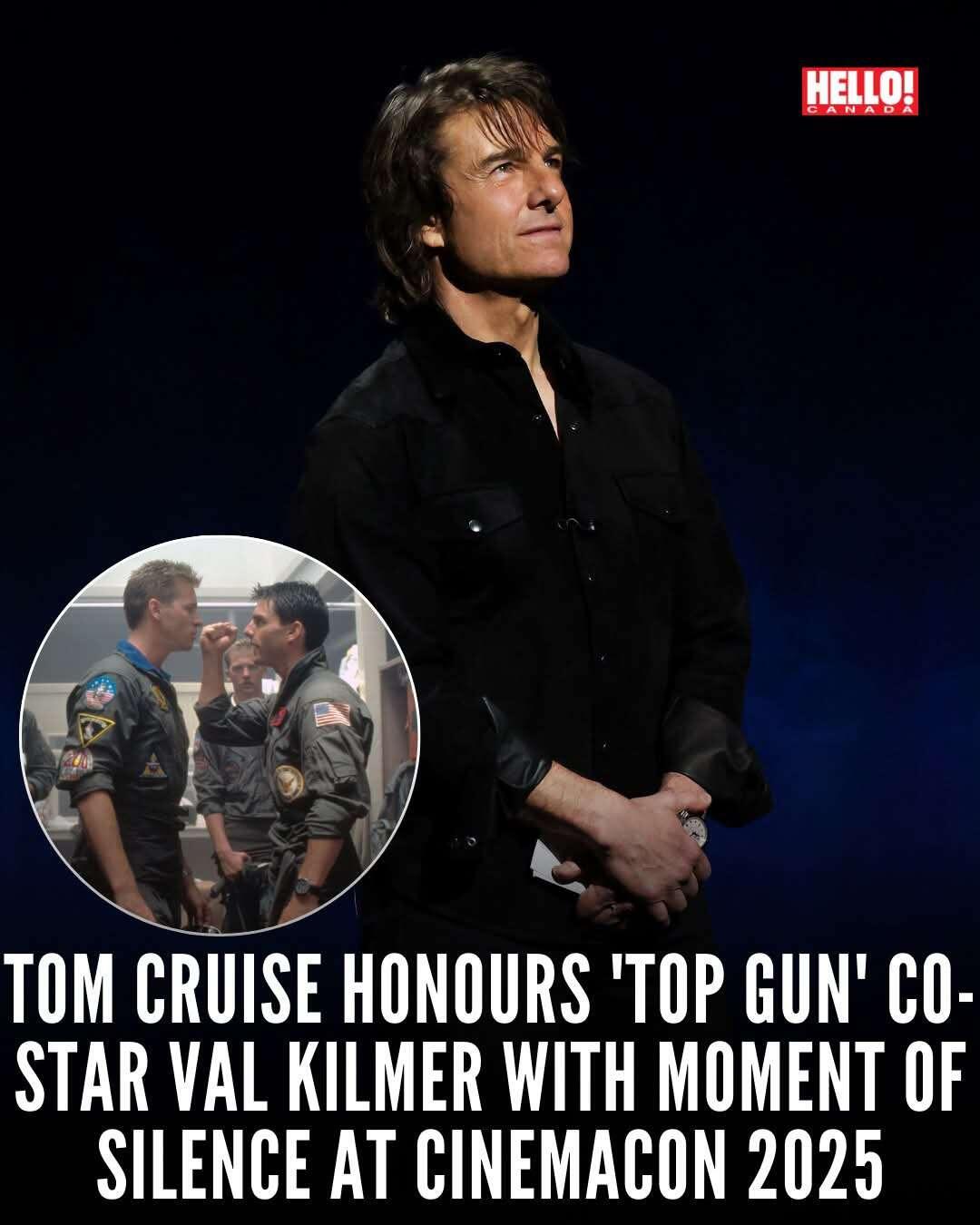

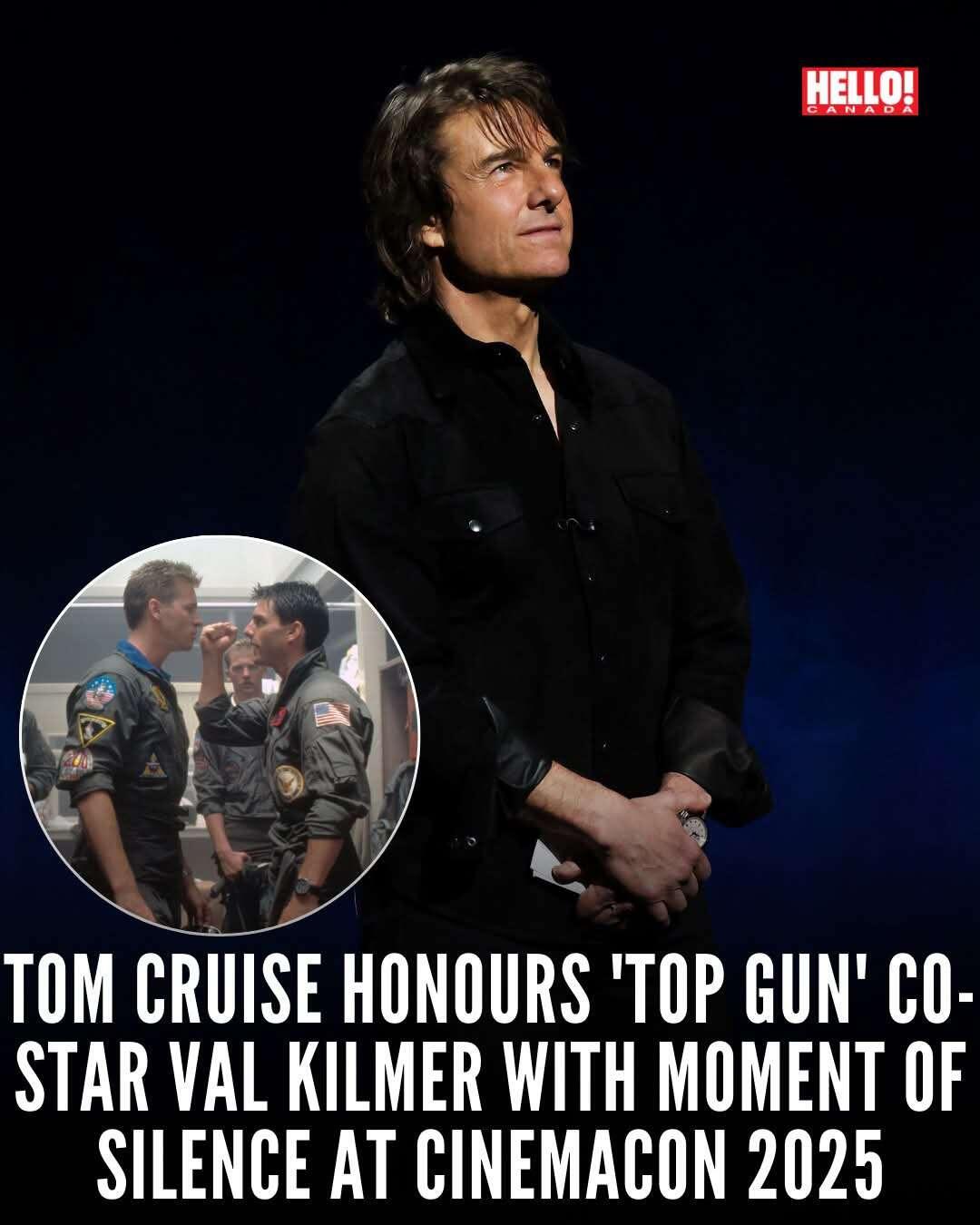

While attending CinemaCon 2025, 62-year-old Tom Cruise honoured his 'Top Gun' co-star, Val Kilmer, who sadly passed away earlier this week at age 65, by leading a moment of silence.

📷: Getty

Credits Goes to the respective

Author ✍️/ Photographer📸

🐇 🕳️

#Bitcoin #Freedom #Apocalypse #Music #Movies #Philosophy #Literature #dogstr #islands #scuba #marinelife #architecture

While attending CinemaCon 2025, 62-year-old Tom Cruise honoured his 'Top Gun' co-star, Val Kilmer, who sadly passed away earlier this week at age 65, by leading a moment of silence.

📷: Getty

Credits Goes to the respective

Author ✍️/ Photographer📸

🐇 🕳️

#Bitcoin #Freedom #Apocalypse #Music #Movies #Philosophy #Literature #dogstr #islands #scuba #marinelife #architecture

While attending CinemaCon 2025, 62-year-old Tom Cruise honoured his 'Top Gun' co-star, Val Kilmer, who sadly passed away earlier this week at age 65, by leading a moment of silence.

📷: Getty

Credits Goes to the respective

Author ✍️/ Photographer📸

🐇 🕳️

#Bitcoin #Freedom #Apocalypse #Music #Movies #Philosophy #Literature #dogstr #islands #scuba #marinelife #architecture

While attending CinemaCon 2025, 62-year-old Tom Cruise honoured his 'Top Gun' co-star, Val Kilmer, who sadly passed away earlier this week at age 65, by leading a moment of silence.

📷: Getty

Credits Goes to the respective

Author ✍️/ Photographer📸

🐇 🕳️

#Bitcoin #Freedom #Apocalypse #Music #Movies #Philosophy #Literature #dogstr #islands #scuba #marinelife #architecture

Karnage

posted

15 days ago

I want to go look at used cameras now…

f41f9a99:93a1fe8e

posted

15 days ago

$83,375.28 / #bitcoin

≅ ₱4,778,570.85

🔴 0.38% ≅ ₱18,291.06

c5337187:a5f35224

posted

15 days ago

Bitcoin Fee: 2 Sat/vB

#bitcoin #fees

c5337187:a5f35224

posted

15 days ago

Bitcoin Lightning Network:

17288 Nodes

46105 Channels

Avg capacity 0.1146 BTC

Total capacity 5281.4364 BTC

#bitcoin #lightning

80b2b76a:a972c5a8

posted

15 days ago

~~~~~~~~~~~~~~~~~~~~~

#Bitcoin BTC/SEK hourly price

~~~~~~~~~~~~~~~~~~~~~

1 BTC: 836,782 sek | 24hr: 2.86%

1 SEK: 119 sats

Market cap: 16,604,632,753,067 sek

Updated: 2025-04-05 | 08:01 CEST

.

posted

15 days ago

Just read strike's faq lol

AK 👸🏻

reacted

15 days ago

😄

AK 👸🏻

reacted

15 days ago

🫂

cuban

reacted

15 days ago

🧡

atyh

reacted

15 days ago

🤙

elsat

posted

15 days ago

nostr:npub1zga04e73s7ard4kaektaha9vckdwll3y8auztyhl3uj764ua7vrqc7ppvc