9279276b:2baa0bcb

posted

a month ago

Something More Profound: The Political Economy Of Network Protocols

by k00b in ~BooksAndArticles

1,564 sats and 3 comments so far

https://stacker.news/items/984794

3c9b6600:6aeff970

posted

a month ago

Bitcoin has DECREASED in DOLLAR. The current price is $106,726.54, the pokémon #106 is Hitmonlee (Fighting) #bitcoin #pokemon #zap

98a7e3f6:15e18646

posted

a month ago

Bitcoin Futures Open Interest Zoom as BTC Inches Towards All-Time High; DOGE, ADA, XRP Add 4% - Bitcoin (BTC) is inches away from its all-time high, hovering over $107,000, with ... - https://www.coindesk.com/markets/2025/05/21/bitcoin-futures-open-interest-zoomas-btc-inches-towards-all-time-high-doge-ada-xrp-add-4 #bitcoinfutures #dogecoin #markets #bitcoin #cardano #news #xrp

8b83ced6:7a4f87e6

posted

a month ago

**A New Investment Paradigm**

For over a century, the dominant motivation for investing has been simple: grow capital and protect it against inflation. From individual savers to trillion-dollar institutions, the goal was to generate a return that at least exceeded the pace at which fiat currencies lost their value. Asset managers built empires on this promise, offering portfolios and strategies to outpace inflation. But what happens when the rules change—when the need to constantly grow wealth to preserve it begins to fade?

Enter #Bitcoin. With its fixed supply, decentralized nature, and resistance to monetary manipulation, Bitcoin represents a new kind of store of value—one that could fundamentally shift why and how we invest.

**The Inflation Imperative: Why We Invest Today**

Traditional investment has been anchored in the reality of inflation. As central banks print money and purchasing power erodes, savers are incentivized to place their capital in assets that grow in value: stocks, bonds, real estate, and increasingly, alternatives. The entire apparatus of modern investing—funds, benchmarks, passive ETFs, active management—is a response to this inflationary pressure.

Asset managers like BlackRock and Vanguard thrive because they provide the infrastructure and insight necessary to preserve and grow wealth in this inflationary environment. Their job is not just to earn returns—it’s to avoid loss via erosion.

**Bitcoin as a Store of Value**

Bitcoin breaks this model. With a hard cap of 21 million coins and no central authority to inflate its supply, Bitcoin offers a value proposition that fiat currencies and even gold cannot: predictability and scarcity. Its decentralized, borderless nature makes it difficult to confiscate or manipulate, and its growing adoption suggests it may increasingly function as a global monetary base.

For investors, this changes the game. If one can hold Bitcoin and preserve wealth without the need for complex portfolios or exposure to volatile markets, then the rationale behind traditional investment begins to weaken. The default action becomes to hold, not to seek returns.

**Investing Beyond Money: The Rise of Purpose-Driven Capital**

In a world where holding Bitcoin is enough to preserve wealth, the question shifts from "How do I protect my money?" to "What is worth investing in?"

This opens the door to purpose-driven capital. Rather than chasing ROI to beat inflation, investors may begin to fund projects and companies that reflect their values, passions, or long-term vision for society. This includes:

- Renewable energy and climate tech

- Social equity initiatives

- Open-source technologies

- Community infrastructure

- Space, biotech, and frontier science

The motivation is not just profit—it’s impact. The metrics become more qualitative: legacy, meaning, contribution.

**The Crisis and Opportunity for Asset Managers**

This shift poses an existential threat to traditional asset managers. If wealth preservation can be achieved by simply holding Bitcoin, the value of complex, fee-laden portfolios diminishes. Large firms like BlackRock must pivot or risk irrelevance.

But there is an opportunity. These institutions can reposition themselves as brokers of purpose:

- Curating portfolios of values-aligned, impactful investments

- Offering tools to measure non-financial returns (e.g., carbon offsets, social impact)

- Advising clients on how to align capital with conscience

In this new role, the asset manager is not just a financial engineer—they are a guide in a moral, social, and philosophical investment journey.

**A New Financial Archetype: The Investment Philosopher**

The next generation of financial advisors may look less like Wall Street traders and more like investment philosophers. They will help clients navigate questions such as:

- What causes do I care about?

- What kind of world do I want my capital to build?

- How can I measure satisfaction beyond returns?

This is already emerging in impact investing, ESG mandates, and regenerative finance. Bitcoin simply accelerates the transition by removing the "survival pressure" of beating inflation.

**Risks and Counterpoints**

Of course, Bitcoin is not without its challenges. Volatility remains high, regulatory uncertainty persists, and adoption is uneven. For now, traditional investments still offer diversification and yield opportunities. Moreover, many investors will still chase returns out of habit or ambition.

Governments may also impose tax policies or incentives that push capital back into conventional markets. And some may argue that a truly post-inflation world is still decades away.

Still, the direction of travel is clear: Bitcoin has planted the seed of a new investment paradigm.

**The Quiet Revolution**

Bitcoin may not loudly overthrow the financial system—but it quietly rewires the motivations behind it. In a world where money no longer leaks value over time, investing becomes a matter of meaning, not necessity.

For investors, the question becomes not just "What will this return?" but "What will this create?"

And for the financial institutions of tomorrow, survival will depend not on beating benchmarks—but on helping clients build a life—and a world—worth investing in.

98a7e3f6:15e18646

posted

a month ago

$100K BTC, 8th Time’s the Charm - Last week the crypto market didn’t just ride on bitcoin’s coattails—it ran with it... - https://news.bitcoin.com/100k-btc-8th-times-the-charm/ #ethereum(eth) #bitcoin(btc) #op-ed

f41f9a99:93a1fe8e

posted

a month ago

$106,801.39 / #bitcoin

≅ ₱5,942,643.10

🔴 0.39% ≅ ₱23,168.79

e8deeca0:4b55db9b

posted

a month ago

#lilyphillips #babestr

#lilyphillips #babestr

98a7e3f6:15e18646

posted

a month ago

Metaplanet is Japan’s Most Shorted Stock, Says CEO Amid Global Short Squeeze Speculation - Dubbed as Japan’s ‘Strategy’, Metaplanet is now the country’s most shorted stock by hedge... - https://cryptonews.com/news/metaplanet-is-japans-most-shorted-stock-says-ceo/ #bitcoinnews #metaplanet #bitcoin

98a7e3f6:15e18646

posted

a month ago

Blackstone Makes First Crypto Move With Investment in BlackRock’s Bitcoin ETF - Key Takeaways:

Blackstone makes first direct crypto investment.

The asset manage... - https://cryptonews.com/news/blackstone-makes-first-crypto-move-with-investment-in-blackrocks-bitcoin-etf/ #bitcoinnews #bitcoinetf #adoption #bitcoin

98a7e3f6:15e18646

posted

a month ago

Bitcoin Price Prediction: Wedge Builds at $108K—Is BTC Ready to Break? - Bitcoin is trading at $108,000, up 1% in the Asian session as financial anxiety bu... - https://cryptonews.com/news/bitcoin-price-prediction-wedge-builds-at-108k-is-btc-ready-to-break/ #cryptocurrency #priceanalysis #bitcoin

c74cfd63:89ab36c8

posted

a month ago

📢 Big surprise les amis 👀

Le site de nostr:nprofile1qqs8dmkck7wpc500kjaagt4alvgsnjjstkj5ptun7u8a7uc93ayl3qspzamhxue69uhhyetvv9ujucm4wfex2mn59en8j6gpp4mhxue69uhkummn9ekx7mqpz3mhxue69uhhyetvv9ujuerpd46hxtnfdufmd8sq⚡️🔥 ⤵️

bitcoinstore.pvh-labs.com/t-shirts

vient d'être lancé 🚀 et pour tout vous dire c'est un sacré cachotier ce Mill3sim3, j'ai été mise dans la confidence seulement hier 😱

Oui hier 😅

Retrouvez y entre autre mes créations 🙌

Il y en a pour tous les goûts et toutes les envies 🧐

Maintenant c'est à vous de jouez, rejoignez-nous et portez fièrement votre passion pour Bitcoin !

#Bitcoin #BitcoinWeek2025 #BitcoinStore #tee-shirts #goodies

⚡️@Mill3sim3 & @Missatoshi_girl ⚡️

ba11337b:9a1f8eb3

posted

a month ago

Bitcoin Price Today: Popular Cryptocurrency Just 2% Away From All-Time High; Ethereum Rises Too https://www.byteseu.com/1030727/ #bitcoin #BitcoinAllTimeHigh #BitcoinETFs #BitcoinFutures #BitcoinMarket #BitcoinPrice #Crypto #CryptoCurrency #Ethereum

UK Space Ambitions Clash With NATO Airspace Concerns

UK Space Ambitions Clash With NATO Airspace Concerns

https://www.cityam.com/britains-space-launch-programme-could-be-thwarted-by-nato/

The UK’s new vertical launch spaceport at Saxa Vord poses risks to Icelandic airspace and territorial waters, potentially disrupting transatlantic flights and marine ecosystems.

Exclusion zones for rocket launches could interfere with NATO's ability to effectively patrol the Greenland-Iceland-United Kingdom gap, an area of strategic importance for defense.

While a memorandum of understanding exists between the UK and Iceland, it may not adequately address the full defense and military ramifications of frequent space launches in this critical region.

When I relocated to the UK from New York in 1984, the Cold War was at its peak. US nuclear and conventional forces were spread across Europe and fears of a Soviet invasion or nuclear exchange were ever-present. In the UK, another critical strategic concern was the Greenland-Iceland-United Kingdom (GIUK) gap, which are two stretches of the North Atlantic separating these three countries. During the Cold War, Soviet naval forces aimed to control this gap to access the broader North Atlantic and block NATO reinforcements to Europe, a scenario famously depicted in Tom Clancy’s Red Storm Rising.

https://cms.zerohedge.com/s3/files/inline-images/Rocket-Launch_LowRes.jpg?itok=6Litlo-t

After the Cold War ended and the so-called Peace Dividend reduced the gap’s significance, its strategic importance faded. However, since 2014, with Russia’s renewed assertiveness, the GIUK gap has regained prominence in NATO planning. The US reopened Keflavik Naval Air Station in Iceland in 2016, re-established its 2nd Fleet in 2018 to protect the gap and, as recently as March 2025, Standing NATO Maritime Group 1 increased its patrols in the region.

I warn of danger

While NATO has prepared for Russian threats, a new risk closer to home is now emerging: the UK’s and Europe’s first vertical launch spaceport at Saxa Vord, Shetland. Ironically, this site was once an RAF early warning and air defence base during the Cold War, bearing the motto Praemoneo de Periculis, or “I warn of danger”.

Commercial space launches are still in their infancy, but recent incidents such as https://www.cityam.com/filtronic-defence-firm-pens-huge-deal-with-elon-musks-spacex/

launch failures – spreading debris across Florida and the Caribbean and grounding flights – and a Norwegian test rocket explosion highlight the risks. Saxa Vord itself attempted a rocket launch last August, resulting in an engine explosion. The international nature of space launches means that countries near Saxa Vord, especially Iceland, are directly in the path of up to 30 planned launches per year, four a month at peak, with ambitions to increase to 40 or 50 annually.

These launches pose multiple risks to Iceland and the GIUK gap:

Rockets may enter Icelandic airspace, with first-stage returns falling through Icelandic airspace and into territorial waters.

Catastrophic failures could scatter debris, whilst hazardous chemicals from rocket propellants threaten marine ecosystems.

Rerouted transatlantic flights of up to 76 a day, according to Icelandic air traffic control’s ‘anonymous’ response to the CAA’s Saxa Vord licence consultation.

Even more importantly and less scrutinised – the presence of exclusion zones for launches could undermine NATO’s ability to patrol the gap effectively.

Memorandum of Misunderstanding

These risks are partly managed by a https://space.blog.gov.uk/2021/08/13/uk-and-iceland-strengthen-ties-for-uk-launch/

(MoU) signed between the UK and Iceland in July 2021. The MoU mandates the closure of designated Icelandic sea and airspace areas before launches and outlines some procedures for debris recovery. However, while a handful of Icelandic officials are aware of the implications, the broader political and media discourse in both countries has yet to grapple with the full defence and military ramifications of the impact of such numbers of launches into NATO’s strategic sea and airspace.

https://cms.zerohedge.com/s3/files/inline-images/SaxaVord-Spaceport-Launch-Site-D.jpg?itok=U61mGCIK

The current trajectory of UK space ambitions – and planned rocket launch from the UK – means the UK’s space ambitions could inadvertently undermine the very security framework that underpins Western interests in the North Atlantic and the Arctic.

There is an urgent need for both the UK and Icelandic governments to reassess the risks from Saxa Vord, ensuring that existing bilateral agreements align the UK’s space programme with enduring geopolitical realities and the security needs of NATO and its allies. Saxa Vord has to be a success – but upon the present strategy security triumphs space whilst Iceland is developing its own space strategy – which might well consider how launch capability could be nationalised to give greater control over risk.

https://cms.zerohedge.com/users/tyler-durden

Wed, 05/21/2025 - 03:30

https://www.zerohedge.com/geopolitical/uk-space-ambitions-clash-nato-airspace-concerns

5f9f0ad3:2043d03e

posted

a month ago

We need more open source ASIC chips fabricated and GigaHasrates through braidpool.

Not whatever bitaxe is doing.

#bitcoin#AskNostr #Nostr

f41f9a99:93a1fe8e

posted

a month ago

$107,215.85 / #bitcoin

≅ ₱5,965,811.89

🔴 0.60% ≅ ₱36,170.07

AK

reposted

a month ago

{"pubkey":"39cc53c9e3f7d4980b21bea5ebc8a5b9cdf7fa6539430b5a826e8ad527168656","id":"5ffb6955e79d71d9d5e1c51f672ea5e18c94b265b953dcec1c9d2aefcad38b99","created_at":1747737665,"sig":"5dcdfb3418093f62ce33164f7adef349d218b756bd2bb4df72ca5ec13e9e6b570d255d281fb434810ce006bac29899f25f46caaea25af53702b088c3cd539724","content":"After months of work, the all-new site is live and packed with new features. Check it out!\n\nhttps:\/\/kycnot.me","kind":1,"tags":[["r","https:\/\/kycnot.me"]]}

bfccad6f:7478a76f

posted

a month ago

Good Morning ☕️ ⛅️ 🌊 you wonderful Nostr people 🫂💜

#Bitcoin

AK

posted

a month ago

😂

7b991f77:76c2840d

posted

a month ago

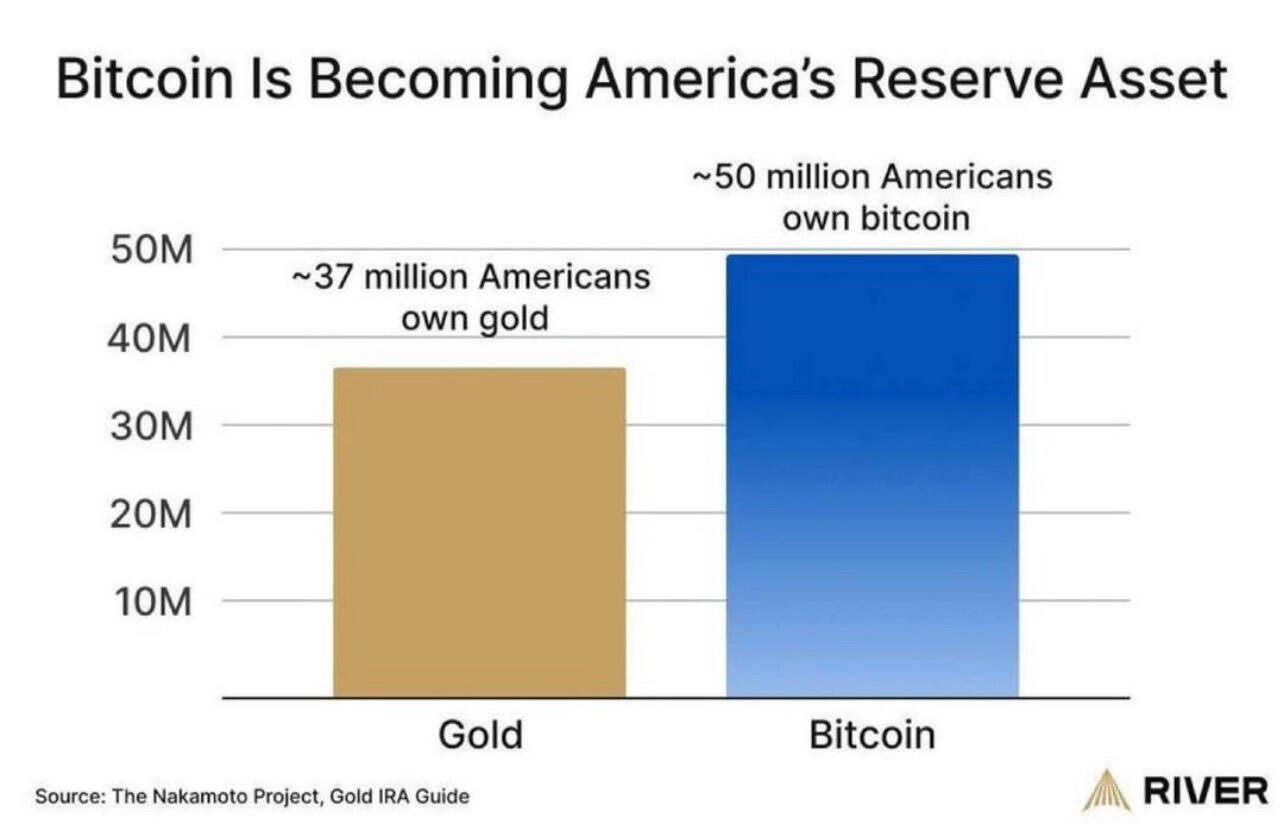

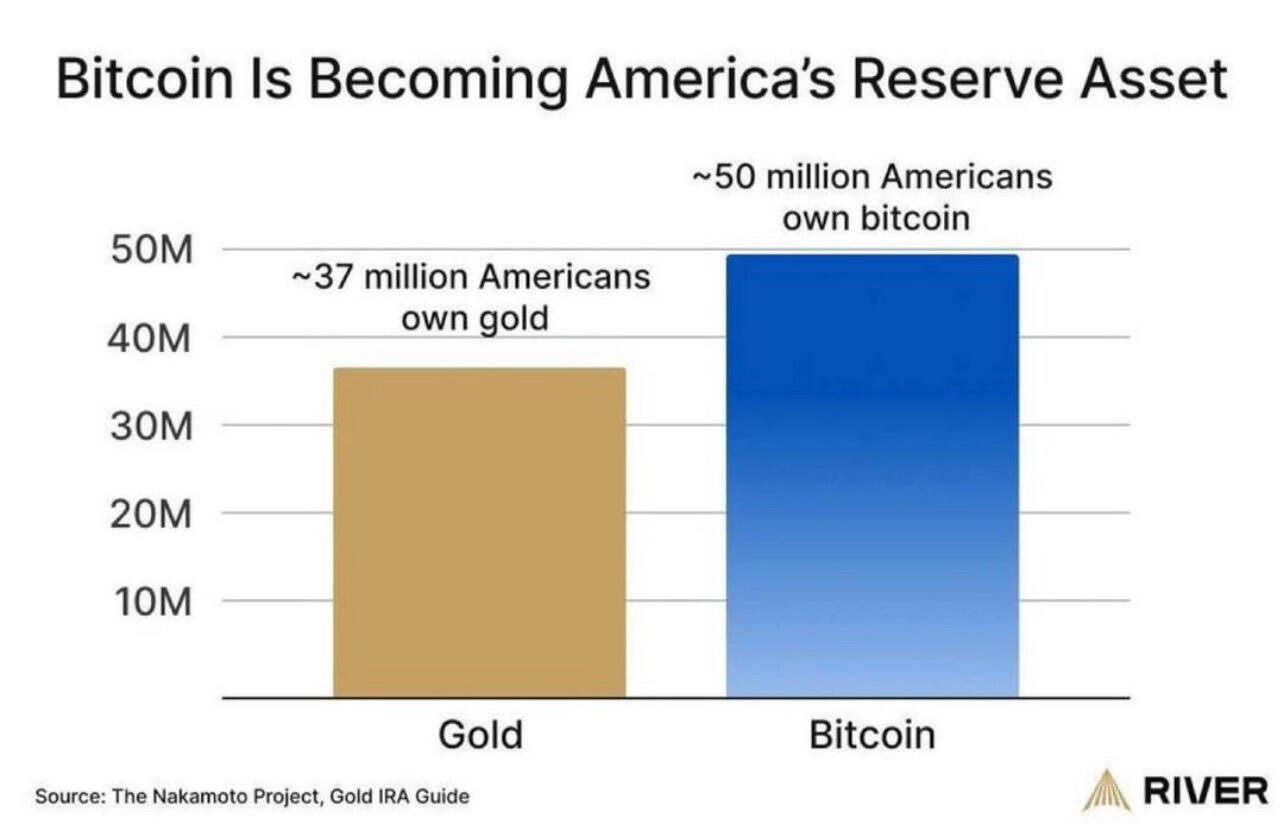

BREAKING: More Americans own #Bitcoin than #Gold. 🇺🇸

84b0c46a:417782f5

reacted

a month ago

🍬

7b991f77:76c2840d

posted

a month ago

The #Bitcoin anal plug of consequences rarely arrives lubed.

280e847e:47d9d77c

posted

a month ago

GM! Today looking at the charts 📈 of #bitcoin and #monero and feeling I’m Demi’s Roussos singing triki-triki

https://youtu.be/qXGUqsx0II8

ff2e4123:cacb9ecd

posted

a month ago

2c7cc62a:622a5cdc

posted

a month ago

ビットコインチャート

80b2b76a:a972c5a8

posted

a month ago

~~~~~~~~~~~~~~~~~~~~~

#Bitcoin BTC/SEK hourly price

~~~~~~~~~~~~~~~~~~~~~

1 BTC: 1,034,981 sek | 24hr: 1.57%

1 SEK: 96 sats

Market cap: 20,547,477,173,709 sek

Updated: 2025-05-21 | 09:01 CEST